Growth in Emerging Markets

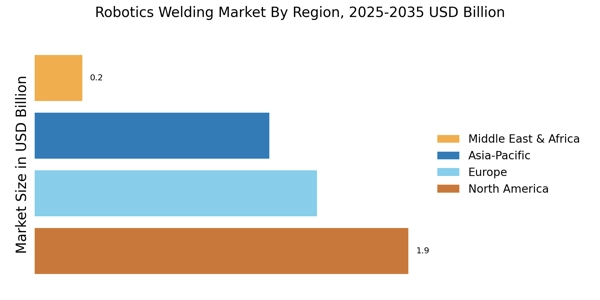

Emerging markets present a substantial opportunity for the Robotics Welding Market. As economies in regions such as Asia-Pacific and Latin America continue to develop, there is a growing demand for advanced manufacturing technologies, including robotic welding systems. These markets are witnessing an increase in industrialization, which drives the need for automation to enhance production capabilities. In 2025, it is projected that the Robotics Welding Market will see significant growth in these regions, fueled by investments in infrastructure and manufacturing. This expansion indicates that companies are likely to focus on establishing a presence in emerging markets to capitalize on the rising demand for efficient and reliable welding solutions.

Labor Shortages and Skills Gap

The Robotics Welding Market is significantly influenced by labor shortages and the skills gap prevalent in many manufacturing sectors. As industries face challenges in finding skilled welders, the adoption of robotic welding solutions becomes a viable alternative. Robotics not only addresses the labor shortage but also enhances productivity and efficiency. In 2025, it is anticipated that the demand for robotic welding systems will increase as companies seek to automate processes to mitigate the impact of workforce limitations. This shift towards automation is likely to reshape the labor landscape, with a growing emphasis on training and upskilling workers to manage and maintain robotic systems within the Robotics Welding Market.

Rising Demand for High-Quality Welds

The Robotics Welding Market experiences a notable increase in demand for high-quality welds across various sectors, including automotive, aerospace, and construction. As industries strive for precision and durability, the integration of robotic welding systems becomes essential. These systems not only enhance the quality of welds but also reduce the likelihood of defects, which can lead to costly rework. In 2025, the market is projected to grow at a compound annual growth rate of approximately 10%, driven by the need for superior welding solutions. This trend indicates that manufacturers are increasingly investing in advanced robotic technologies to meet stringent quality standards, thereby propelling the Robotics Welding Market forward.

Technological Advancements in Robotics

Technological advancements play a pivotal role in shaping the Robotics Welding Market. Innovations such as artificial intelligence, machine learning, and enhanced sensor technologies are revolutionizing the capabilities of robotic welding systems. These advancements enable robots to adapt to varying welding conditions and improve their efficiency. For instance, the introduction of real-time monitoring systems allows for immediate adjustments during the welding process, ensuring optimal performance. As a result, the market is expected to witness a surge in the adoption of these advanced systems, with estimates suggesting a market value exceeding 5 billion by 2026. This evolution in technology is likely to attract new players and investments in the Robotics Welding Market.

Sustainability and Environmental Regulations

Sustainability concerns and stringent environmental regulations are driving changes within the Robotics Welding Market. Companies are increasingly required to adopt eco-friendly practices, which include reducing waste and energy consumption during the welding process. Robotic welding systems are designed to optimize material usage and minimize emissions, aligning with these sustainability goals. As regulations become more rigorous, the demand for robotic solutions that comply with environmental standards is expected to rise. This trend suggests that the Robotics Welding Market will not only focus on efficiency but also on sustainable practices, potentially leading to innovations that further enhance environmental performance.