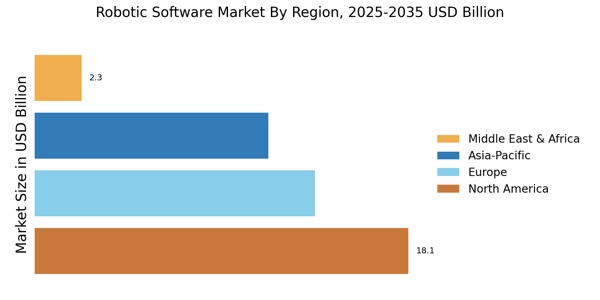

North America : Innovation and Investment Hub

North America is the largest market for robotic software, holding approximately 40% of the global share. The region's growth is driven by significant investments in automation technologies, increasing demand for efficiency in manufacturing, and supportive government policies promoting innovation. The presence of major tech companies and research institutions further catalyzes market expansion, with a focus on AI integration and advanced robotics.

The United States is the leading country in this sector, followed by Canada. Key players such as Rockwell Automation, Intuitive Surgical, and NVIDIA dominate the landscape, fostering a competitive environment. The region benefits from a robust infrastructure and a skilled workforce, enabling rapid adoption of robotic solutions across various industries, including healthcare, manufacturing, and logistics.

Europe : Regulatory Support and Growth

Europe is the second-largest market for robotic software, accounting for around 30% of the global market share. The region's growth is fueled by stringent regulations aimed at enhancing workplace safety and productivity, alongside a strong emphasis on sustainability. Countries like Germany and France are at the forefront, with government initiatives supporting research and development in robotics and automation technologies.

Germany leads the European market, followed by France and the UK. Major players such as KUKA, Siemens, and ABB are heavily invested in innovation, driving competition and technological advancements. The European market is characterized by a collaborative ecosystem involving academia, industry, and government, which fosters the development of cutting-edge robotic solutions. The European Commission states, "The EU aims to be a global leader in robotics and AI, ensuring ethical and sustainable development."

Asia-Pacific : Rapid Growth and Adoption

Asia-Pacific is witnessing rapid growth in the robotic software market, holding approximately 25% of the global share. The region's expansion is driven by increasing industrial automation, a growing manufacturing base, and rising investments in technology. Countries like Japan and China are leading the charge, with government initiatives promoting smart manufacturing and robotics as key components of economic growth.

Japan is the largest market in the region, followed closely by China and South Korea. Key players such as Fanuc, Yaskawa, and Omron are pivotal in shaping the competitive landscape. The region is characterized by a high adoption rate of robotics in sectors like automotive, electronics, and healthcare, supported by a strong supply chain and technological advancements. The focus on innovation and efficiency continues to drive demand for robotic software solutions.

Middle East and Africa : Emerging Opportunities Ahead

The Middle East and Africa region is gradually emerging in the robotic software market, currently holding about 5% of the global share. The growth is primarily driven by increasing investments in automation across various sectors, including oil and gas, manufacturing, and healthcare. Countries like the UAE and South Africa are leading the way, with government initiatives aimed at diversifying economies and enhancing technological capabilities.

The UAE is at the forefront, with significant investments in smart technologies and robotics. South Africa follows closely, focusing on improving industrial efficiency. The competitive landscape is evolving, with both local and international players entering the market. The region's potential for growth is substantial, as businesses increasingly recognize the value of robotic solutions in enhancing productivity and operational efficiency.