Research Methodology on RF Gan Market

1. INTRODUCTION

The study of the global RF-GAN Market has been conducted by Market Research Future (MRFR). The report looks into the global RF-GAN market and outlines its growth trajectory over the years. The report provides an in-depth analysis of the factors driving the RF-GAN market and the strategies adopted by the key players. The report is also an effort to identify the current and projected future status of the global market.

2. RESEARCH OBJECTIVES

The research objectives of this study are:

- To provide an overview of the global RF-GAN market.

- To evaluate the demand and supply of the RF-GAN technology.

- To analyze the drivers and trends influencing the global RF-GAN market.

- To provide an in-depth analysis of the strategic decisions taken by the key players operating in the global RF-GAN market.

- To analyze the competitive landscape of the global RF-GAN market.

- To estimate the market size and forecast the market trend from 2023 to 2030.

- To provide strategic recommendations regarding the global RF-GAN market.

3. RESEARCH METHODOLOGY

Market Research Future’s (MRFR) researchers have adopted a comprehensive mixture of primary and secondary research to describe the global RF-GAN market. The primary research has been primarily conducted by interviewing market professionals, industry gurus, executives, and C-level executives in the respective domains. The secondary research includes an in-depth review of the qualitative and quantitative research dedicated to the RF-GAN market.

The research methodology employed by MRFR to assess the global RF-GAN market consists of the following:

3.1 Primary Research

The collected data from the primary research includes inputs from leading industry experts. Primary interviews for the research report have been conducted with industry professionals including managers, directors, COOs, CFOs, and executives. Primary interviews have been conducted with the key opinion leaders of the RF-GAN market.

3.2 Secondary Research

The secondary research includes an extensive study of financial records, recent developments, and technological advancements. Additionally, information from public sources related to the RF-GAN market such as industry magazines, whitepapers, articles, and press releases have been included in the research report.

3.3 Market Breakdown and Data Triangulation

The collected data from two sources have been combined to create an exact market value and market size of the RF-GAN market. To determine the global RF-GAN market, a thorough market breakdown has been conducted which is carried out at both the regional and global level.

4. MARKET SEGMENTATION

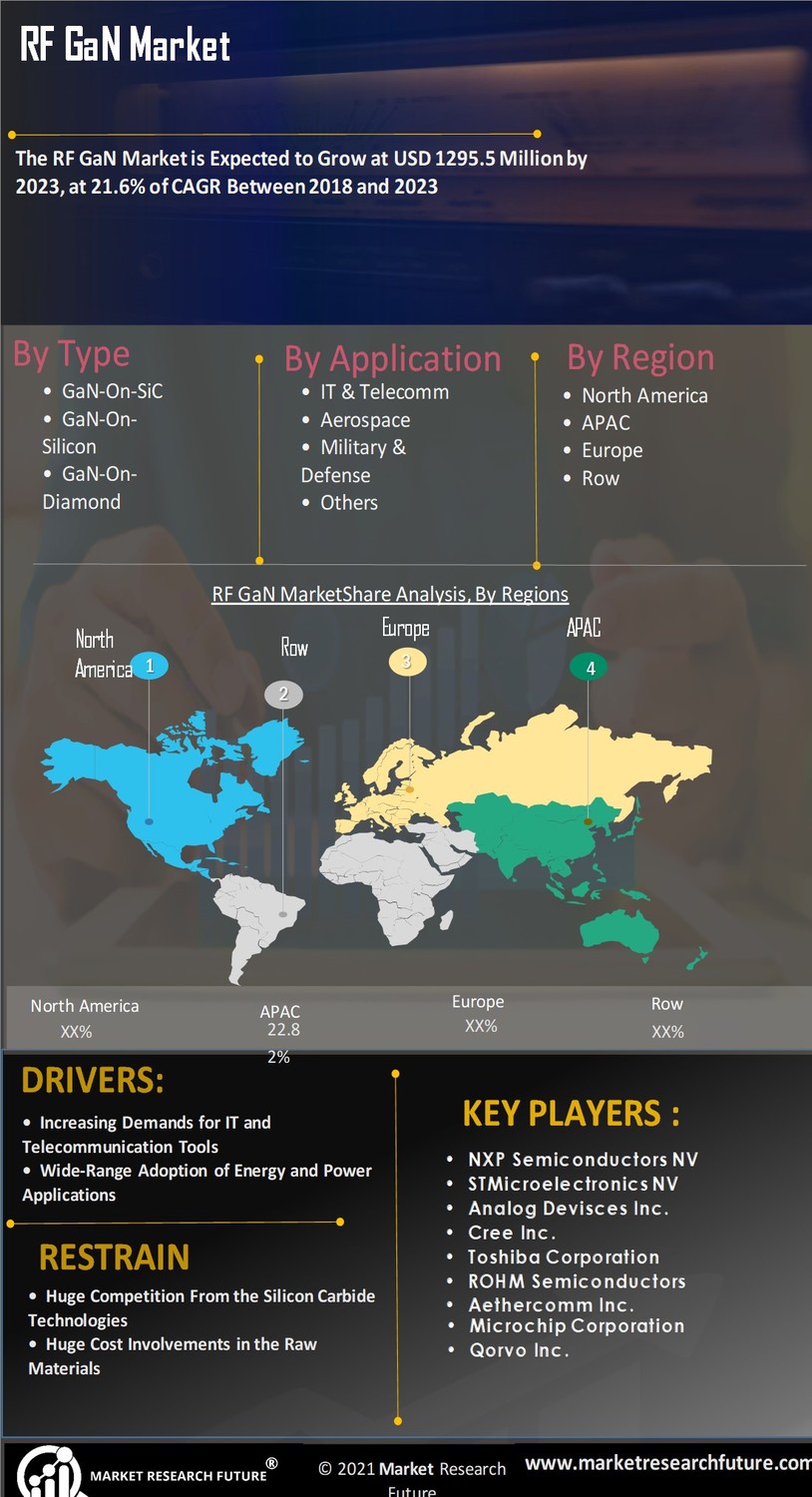

The global RF-GAN market has been studied in the report by region and component segment.

4.1 By Component

The component segment in the report has been segmented into RF-GAN system, RF-GAN chipset, software, and services.

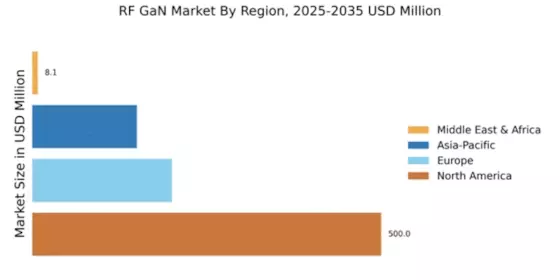

4.2 By Region

The global RF-GAN market has been studied in the geographical segments of North America, Europe, Asia Pacific, and the Rest of the World (RoW).

5. MARKET ATTENDEES

The stakeholders of the RF-GAN market include semiconductor and component manufacturers, component testing and inspection companies, software providers, and distributors.