RF Test Equipment Market Summary

As per Market Research Future analysis, the RF Test Equipment Market Size was estimated at 4.28 USD Billion in 2024. The RF Test Equipment industry is projected to grow from 4.545 USD Billion in 2025 to 8.295 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.2% during the forecast period 2025 - 2035

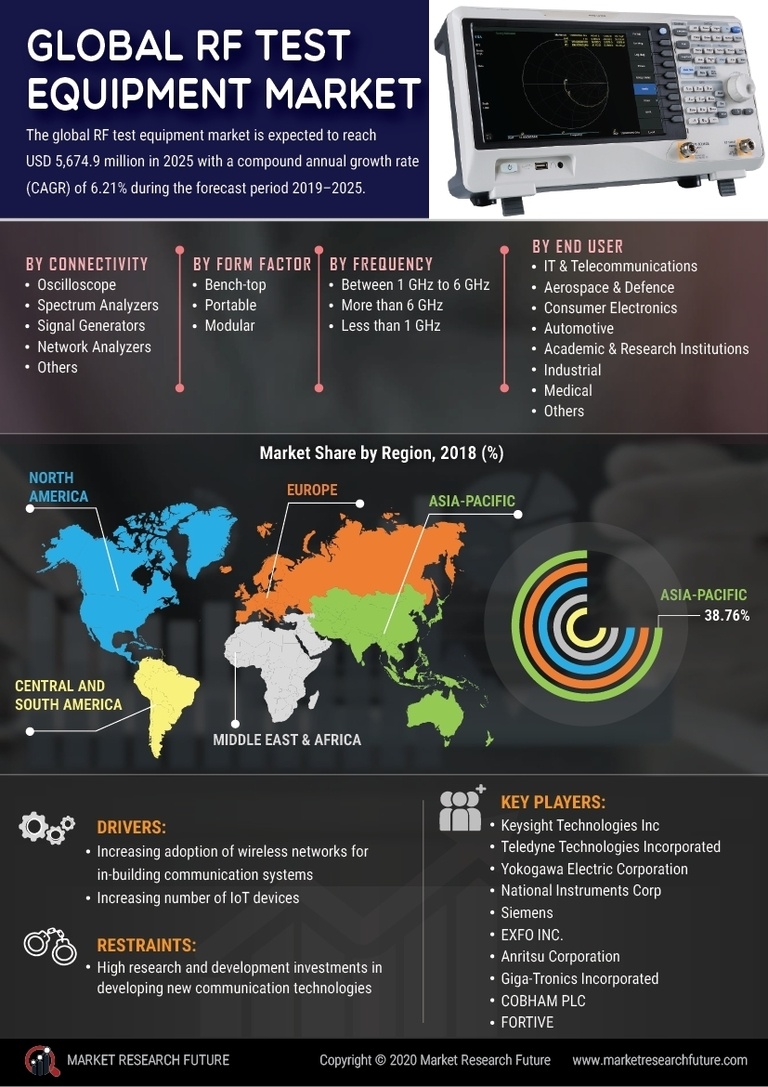

Key Market Trends & Highlights

The RF Test Equipment Market is poised for substantial growth driven by technological advancements and increasing demand for wireless communication.

- The market is witnessing significant advancements in 5G technology, enhancing the capabilities of RF test equipment.

- Miniaturization of testing devices is becoming a prominent trend, allowing for more efficient and portable solutions.

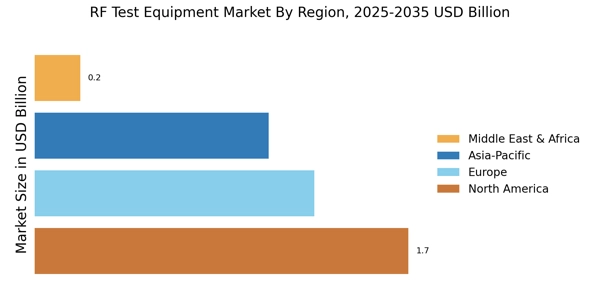

- North America remains the largest market, while Asia-Pacific is emerging as the fastest-growing region in RF test equipment.

- Key drivers include the increasing demand for wireless communication and the integration of artificial intelligence in testing solutions.

Market Size & Forecast

| 2024 Market Size | 4.28 (USD Billion) |

| 2035 Market Size | 8.295 (USD Billion) |

| CAGR (2025 - 2035) | 6.2% |

Major Players

Keysight Technologies (US), Rohde & Schwarz (DE), Anritsu Corporation (JP), Tektronix (US), National Instruments (US), Viavi Solutions (US), Aeroflex (US), Cobham (GB), Spirent Communications (GB)