Increased Appliance Longevity

The desire for longer-lasting household appliances is significantly influencing the Residential Water Softener Consumables Market. Hard water can cause mineral deposits that reduce the efficiency and lifespan of appliances such as dishwashers and commercial water heaters. By utilizing water softeners, homeowners can mitigate these issues, leading to a growing demand for consumables that support these systems. The market data indicates that households using water softeners can extend the life of their appliances by up to 30%. This potential for cost savings and enhanced appliance performance is likely to drive further investment in the Residential Water Softener Consumables Market.

Rising Water Quality Concerns

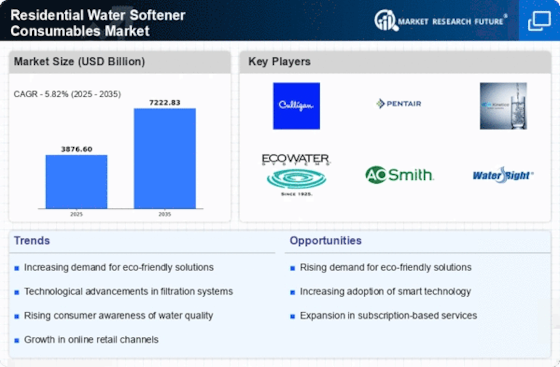

The increasing awareness regarding water quality is a pivotal driver for the Residential Water Softener Consumables Market. Consumers are becoming more cognizant of the adverse effects of hard water, which can lead to scale buildup in plumbing and appliances. This awareness is prompting homeowners to invest in water softening solutions, thereby driving demand for consumables such as salt and resin. According to recent data, the market for water softeners is projected to grow at a compound annual growth rate of approximately 8% over the next few years. As consumers prioritize the quality of their water supply, the Residential Water Softener Consumables Market is likely to experience sustained growth.

Growing DIY Home Improvement Trends

The rising trend of do-it-yourself home improvement projects is significantly impacting the Residential Water Softener Consumables Market. Homeowners are increasingly taking on projects that enhance their living spaces, including the installation of water softening systems. This trend is driving demand for consumables, as DIY enthusiasts seek to maintain and replenish their systems. Market data indicates that the DIY home improvement sector has seen a surge, with a notable increase in sales of water softening products. As more consumers engage in DIY projects, the Residential Water Softener Consumables Market is poised for growth, reflecting the changing dynamics of consumer behavior.

Regulatory Standards and Guidelines

Government regulations regarding water quality and safety are emerging as a significant driver for the Residential Water Softener Consumables Market. Many regions are implementing stricter guidelines to ensure that water supplied to households meets certain quality standards. This regulatory environment is encouraging homeowners to adopt water softening solutions to comply with these standards. As a result, the demand for consumables such as salt and filters is expected to rise. The Residential Water Softener Consumables Market may see a boost as consumers seek to adhere to these regulations, thereby enhancing the overall market landscape.

Technological Advancements in Water Softening

Innovations in water softening technology are playing a crucial role in shaping the Residential Water Softener Consumables Market. The introduction of smart water softeners, which can monitor water usage and optimize salt consumption, is attracting consumers who seek efficiency and convenience. These advancements not only improve the performance of water softeners but also reduce the frequency of consumable replacement. Market analysis suggests that the integration of technology in water softening systems could lead to a 15% increase in the adoption rate of these products. Consequently, the Residential Water Softener Consumables Market is likely to benefit from this trend.