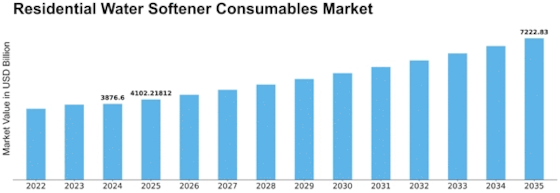

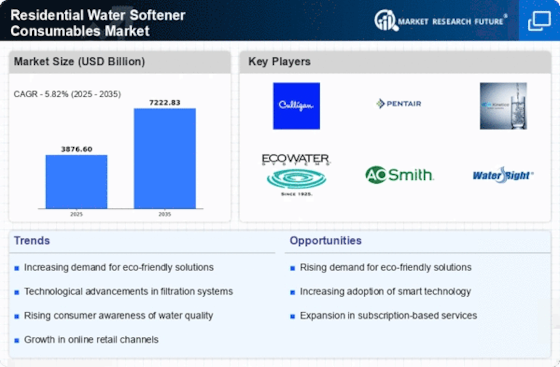

Residential Water Softener Consumables Size

Residential Water Softener Consumables Market Growth Projections and Opportunities

The global residential water softening consumables market is set to experience significant growth, driven by several factors such as increasing awareness about water-borne diseases, ongoing smart city projects in developing countries, and a rise in water contamination concerns. The market is categorized based on type and region, with various segments contributing to its overall dynamics.

Looking at the types of residential water softening consumables, the market is divided into four main categories: resin, salt, cleaners, and filters. Among these, the filters segment took the lead in 2020, holding the largest market share at 35.45%, equivalent to a market value of USD 1,074.5 million. This segment is expected to maintain robust growth, projecting a Compound Annual Growth Rate (CAGR) of 6.16% during the forecast period.

Regionally, Asia-Pacific emerged as the dominant player in the residential water softening consumables market in 2020, capturing a substantial market share of 35.82% and reaching a market value of USD 1,085.6 million. The Asia-Pacific region is anticipated to sustain this momentum, with a projected CAGR of 6.97% over the forecast period.

The escalating awareness surrounding water-borne diseases has become a significant catalyst for the market's growth trajectory. Consumers are increasingly recognizing the importance of ensuring their household water is free from contaminants that could pose health risks. Water softening consumables, particularly filters, play a crucial role in enhancing water quality and safeguarding individuals from water-related illnesses.

In parallel, the ongoing smart city projects in developing countries contribute to the market's expansion. As cities evolve into smart ecosystems, there is a heightened focus on ensuring the delivery of clean and safe water to residents. Residential water softening consumables become integral components of these initiatives, contributing to improved water quality within urban areas.

The surge in water contamination concerns further propels the demand for residential water softening consumables. Pollution, industrial discharges, and environmental factors contribute to the deterioration of water quality. Consumers are increasingly turning to water softening solutions to address issues related to hard water and contaminants, ensuring a healthier and safer water supply for their households.

Delving into the specific types of residential water softening consumables, filters emerge as the leading segment. Filters play a vital role in removing impurities, particles, and contaminants from water, providing an effective solution for enhancing water quality. The dominance of the filters segment is reflected in its substantial market share and the projected robust CAGR, indicating sustained demand for these consumables.

Geographically, Asia-Pacific stands out as a key player in the residential water softening consumables market. The region's significant market share and projected CAGR underscore its role as a growth engine for the industry. Factors such as population growth, urbanization, and rising disposable incomes contribute to the increasing demand for water softening consumables in Asia-Pacific.

As the market continues to evolve, manufacturers and stakeholders in the residential water softening consumables industry are poised to capitalize on these growth drivers. Innovation in product development, increased marketing efforts to raise awareness, and strategic partnerships with stakeholders involved in smart city projects can position companies for success in this dynamic market.

The global residential water softening consumables market is on a growth trajectory fueled by heightened awareness, smart city initiatives, and concerns about water contamination. The market's segmentation by type and region provides valuable insights into the specific dynamics driving its expansion. As the demand for water softening consumables, especially filters, continues to rise, the industry is presented with opportunities to address evolving consumer needs and contribute to ensuring access to clean and safe water for households worldwide.

Leave a Comment