Regulatory Compliance

Regulatory compliance is a critical driver in the Releasing Agent Market. As governments worldwide implement stricter regulations regarding chemical safety and environmental protection, manufacturers are compelled to adapt their formulations accordingly. Compliance with regulations such as REACH and FDA standards is essential for market access and consumer trust. This has led to an increased focus on developing releasing agents that meet safety and environmental criteria. Companies that proactively address these regulations are likely to gain a competitive edge, as they can assure customers of their commitment to safety and sustainability. Consequently, regulatory compliance is not only a necessity but also a strategic driver for growth in the Releasing Agent Market.

Diverse Application Areas

The Releasing Agent Market is characterized by its diverse application areas, which significantly contribute to its growth. Releasing agents are utilized across various sectors, including food processing, construction, and automotive manufacturing. In the food industry, for example, the demand for non-stick coatings in baking and cooking applications is rising, leading to increased consumption of releasing agents. Similarly, in construction, the use of releasing agents in concrete molds is essential for achieving high-quality finishes. Market data indicates that the automotive sector is also expanding its use of releasing agents for composite materials, further driving demand. This diversity in applications ensures a steady growth trajectory for the Releasing Agent Market.

Technological Innovations

Technological innovations play a pivotal role in shaping the Releasing Agent Market. Advancements in formulation technologies have led to the development of high-performance releasing agents that improve efficiency and reduce waste. For instance, the introduction of silicone-based agents has revolutionized the industry by providing superior release properties and thermal stability. Furthermore, automation and digitalization in manufacturing processes are enhancing production capabilities, allowing for more precise application and consistency. The integration of smart technologies, such as IoT, is also emerging, enabling real-time monitoring and optimization of releasing agent usage. These innovations are expected to drive market growth, with a projected increase in demand for technologically advanced solutions.

Sustainability Initiatives

The Releasing Agent Market is increasingly influenced by sustainability initiatives. Manufacturers are under pressure to develop eco-friendly releasing agents that minimize environmental impact. This shift is driven by consumer demand for greener products and regulatory requirements aimed at reducing carbon footprints. As a result, companies are investing in research and development to create biodegradable and non-toxic alternatives. The market for sustainable releasing agents is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 5% in the coming years. This trend not only aligns with global environmental goals but also enhances brand reputation, making sustainability a key driver in the Releasing Agent Market.

Rising Demand in Emerging Markets

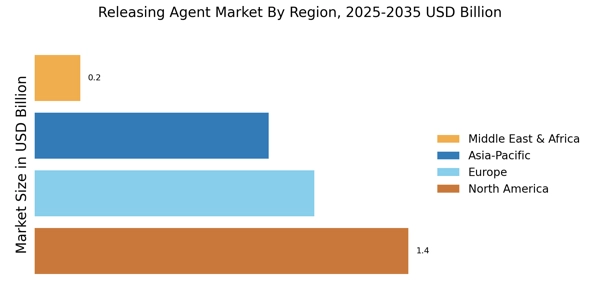

The Releasing Agent Market is witnessing rising demand in emerging markets, which serves as a significant growth driver. As industrialization accelerates in regions such as Asia-Pacific and Latin America, the need for efficient manufacturing processes is increasing. This trend is particularly evident in sectors like construction and automotive, where the use of releasing agents is becoming more prevalent. Market analysis suggests that the Asia-Pacific region is expected to account for a substantial share of the market, driven by rapid urbanization and infrastructure development. Additionally, the growing middle class in these regions is leading to increased consumption of packaged food, further boosting the demand for releasing agents in food processing applications. This emerging market potential presents lucrative opportunities for stakeholders in the Releasing Agent Market.