Market Trends

Key Emerging Trends in the Refurbished Smartphone Market

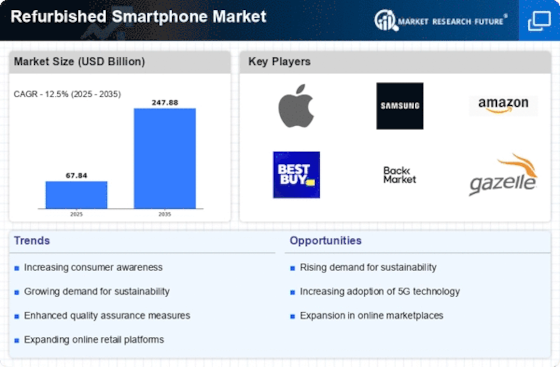

The global market for refurbished smartphones is undertaking frequent notable tendencies that are modeling the industry and inducing consumer inclinations. One obvious tendency is the appearance of user receipt of refurbished devices as a clever and cost-effective substitute for brand-new smartphones. Environmental perception is also driving market tendencies for refurbished smartphones in the global market. With a global consciousness of electronic waste and its effect on the environment, customers are showing an escalating concern about sustainable habits. Many users now examine buying a refurbished smartphone as a liable choice, contributing to a circular economy. The emergence of accredited refurbished programs from foremost companies is an extra notable trend. Distinguishing the accelerating demand for refurbished devices, several primary smartphone products have determined their refurbishment procedures. These procedures assure users of the superiority and legitimacy of the refurbished outcomes, presenting a sense of peace of mind and security. Moreover, to specialized options, the third-party refurbishment subdivision is also increasing, paying to the variation of available choices for clients. Standalone refurbishing corporations play a fundamental part in the market, presenting a diversity of models and price points. Likewise, the mounting importance of quality control and consistent refurbishment procedures is a vital trend in the market.

Purchasers are becoming more aware of the circumstances of refurbished devices, asking for confidence that the phones undertake thorough testing and refurbishment procedures. The market is also undergoing a spill in online sales and e-commerce policies as principal channels for refurbished smartphone connections. The closeness of online shopping, fastened with the accessibility of varied bounds of refurbished simulations, has provided the mounting reputation of online platforms. Moreover, the market trends in refurbished smartphones are intently furrowed to the general smartphone industry. The relief of fresh flagship prototypes repeatedly stimulates the convenience and evaluation of previous gadgets in the refurbished category. In the end, the global market for refurbished smartphones is suffering vigorous movements steered by consumer inclinations, ecological awareness, industry programs, and technological developments.

Leave a Comment