Refurbished Smartphone Size

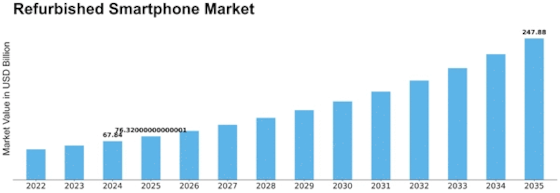

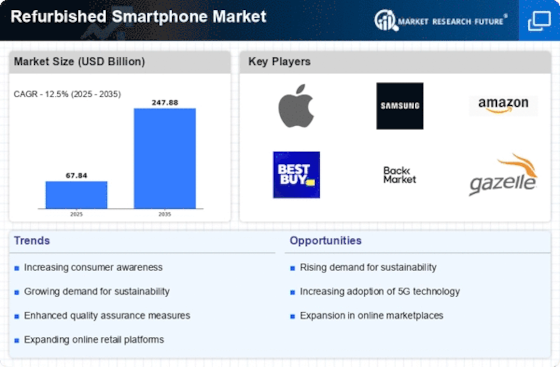

Refurbished Smartphone Market Growth Projections and Opportunities

Several market aspects influence the conditions of the global market for refurbished smartphones, inducing its development, competitiveness, and consumer acceptance. One decisive aspect is the ascending demand for reasonable choices for new smartphones. The market gains from this demand as it bids users the opportunity to retrieve high-quality gadgets at a section of the initial cost, directing a key commercial regard for several consumers. Environmental sustainability is a major market aspect inducing the development of the global market for refurbished smartphones. Refurbished smartphones associate with this tendency by advocating the extension of their lifespan, reuse of surviving devices, and minimizing the requirement for new fabrication. As new models and features are repeatedly presented in smartphone production, consumers renew their devices, backing the arrival of used phones into the refurbishment procedure. The accessibility of modern models in the refurbished market improves consumer relevance, offering an avenue for parties to experience modern technology without the immense price tag correlated with brand-new devices. Consumers entrust a vital market aspect that considerably weighs the success of the global market for refurbished smartphones. Building and preserving confidence is fundamental for refurbishing manufacturers, retailers, and companies.

The founding of specialized refurbished agendas by main manufacturers has played a pivotal part in imparting assurance to buyers, as these courses present identification of endorsement from the unique brand, strengthening the trustworthiness of refurbished products. Government guidelines and industry specifications denote extra market characteristics that model the global market for refurbished smartphones. Government proposals that sponsor the accountable disposal and recycling of electronic waste also contribute to the overall market platform, reinforcing the importance of sustainable methods within the industry. Market competition is a compelling force that models the approaches of corporations driving in the refurbished smartphone space. Determined smartphone companies, as well as specific refurbishing businesses, compete for consumer consideration by suggesting varied competitive pricing, a range of patterns, and modern refurbishment procedures. The closeness of online platforms and e-commerce passages signifies a market aspect that considerably impacts the global market for refurbished smartphones. The aid of buying refurbished devices online has provided consumers with the ability to browse, market availability, assess estimates, and make learned decisions from the relief of their homes. In the end, the global market for refurbished smartphones is prejudiced by an assembly of aspects, including market competition, environmental considerations, trust-building initiatives, regulatory frameworks, technological developments, consumer demand for affordability, and the convenience of online stations.

Leave a Comment