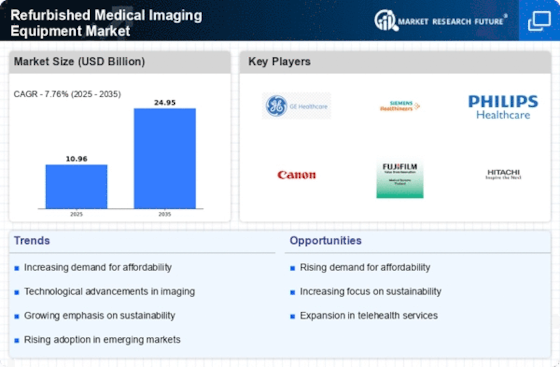

The Refurbished Medical Imaging Equipment Market is currently characterized by a dynamic competitive landscape, driven by technological advancements, cost efficiency, and an increasing demand for high-quality imaging solutions. Major players such as GE Healthcare (US), Siemens Healthineers (DE), and Philips Healthcare (NL) are strategically positioned to leverage their extensive portfolios and established reputations. GE Healthcare (US) focuses on innovation and sustainability, emphasizing the refurbishment of equipment to extend product life cycles. Siemens Healthineers (DE) appears to prioritize digital transformation, integrating advanced software solutions into their refurbished offerings. Philips Healthcare (NL) is likely concentrating on regional expansion, particularly in emerging markets, to capture a broader customer base. Collectively, these strategies shape a competitive environment that is increasingly focused on quality, technological integration, and customer-centric solutions.

In terms of business tactics, companies are localizing manufacturing and optimizing supply chains to enhance operational efficiency. The market structure is moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to emerge, yet the collective strength of major companies ensures a competitive balance that drives innovation and quality improvements across the sector.

In August 2025, GE Healthcare (US) announced a partnership with a leading telehealth provider to enhance remote diagnostics capabilities for refurbished imaging equipment. This strategic move is significant as it aligns with the growing trend of telemedicine, allowing healthcare facilities to maximize the utility of refurbished equipment while improving patient access to imaging services. Such partnerships may enhance GE's market position by integrating advanced technologies into their refurbished offerings.

In September 2025, Siemens Healthineers (DE) launched a new refurbishment program aimed at increasing the energy efficiency of their imaging systems. This initiative not only addresses sustainability concerns but also positions Siemens as a leader in environmentally responsible practices within the refurbished market. The focus on energy efficiency could resonate well with healthcare providers looking to reduce operational costs and environmental impact, thereby enhancing Siemens' competitive edge.

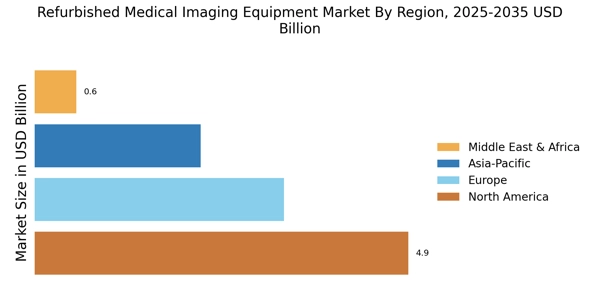

In July 2025, Philips Healthcare (NL) expanded its refurbishment facilities in Asia, aiming to meet the rising demand for affordable imaging solutions in the region. This expansion is indicative of Philips' strategy to localize production and reduce lead times, which may enhance their responsiveness to market needs. By increasing capacity in a high-demand area, Philips is likely to strengthen its foothold in the Asian market, which is becoming increasingly important for the global healthcare landscape.

As of October 2025, current competitive trends in the Refurbished Medical Imaging Equipment Market are heavily influenced by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the value of collaboration in enhancing technological capabilities and market reach. Looking ahead, competitive differentiation is expected to evolve from traditional price-based competition to a focus on innovation, advanced technology, and reliable supply chains. This shift may redefine how companies position themselves in the market, emphasizing the importance of quality and technological advancement over mere cost considerations.