Decentralized Power Generation

The Reciprocating Power Generating Engine Market is benefiting from the trend towards decentralized power generation. As energy consumers increasingly seek to generate their own power, reciprocating engines are becoming a preferred choice due to their flexibility and scalability. This trend is particularly evident in remote areas and developing regions where access to centralized power grids is limited. The ability to deploy smaller, modular power generation units allows for tailored solutions that meet specific energy needs. Furthermore, the rise of microgrids and distributed energy resources is likely to enhance the demand for reciprocating engines, as they can efficiently provide backup power and support renewable energy integration. This shift could lead to a significant increase in market opportunities for manufacturers and service providers.

Shift Towards Alternative Fuels

The Reciprocating Power Generating Engine Market is witnessing a shift towards alternative fuels, which is reshaping the landscape of power generation. With growing concerns over fossil fuel dependency and environmental sustainability, there is a marked increase in the use of biofuels, natural gas, and hydrogen in reciprocating engines. This transition not only helps in reducing greenhouse gas emissions but also aligns with regulatory frameworks aimed at promoting cleaner energy sources. According to recent data, the market for natural gas-powered reciprocating engines is expected to expand significantly, driven by the increasing availability of natural gas and its cost-effectiveness compared to traditional fuels. This trend indicates a potential for substantial growth in the market as industries seek to adopt cleaner technologies.

Regulatory Support for Clean Energy

The Reciprocating Power Generating Engine Market is increasingly influenced by regulatory support aimed at promoting clean energy solutions. Governments worldwide are implementing policies and incentives to encourage the adoption of cleaner technologies, including reciprocating engines that utilize alternative fuels. These regulations often include tax credits, grants, and subsidies for businesses that invest in cleaner energy systems. As a result, the market is likely to see a surge in investments as companies seek to comply with stringent environmental standards. Additionally, international agreements focused on reducing carbon emissions are further propelling the demand for efficient and low-emission power generation technologies. This regulatory landscape presents a favorable environment for the growth of the reciprocating power generating engine market.

Rising Demand for Backup Power Solutions

The Reciprocating Power Generating Engine Market is experiencing a rising demand for backup power solutions, driven by increasing concerns over power reliability and grid stability. Industries, commercial establishments, and even residential users are seeking dependable power sources to mitigate the risks associated with power outages. Reciprocating engines are particularly well-suited for this purpose due to their quick start-up times and ability to provide consistent power output. The market for backup power systems is projected to grow significantly, with estimates suggesting a potential increase of over 6% annually in the coming years. This trend indicates a robust opportunity for manufacturers of reciprocating engines to cater to the growing need for reliable and efficient backup power solutions.

Technological Advancements in Engine Design

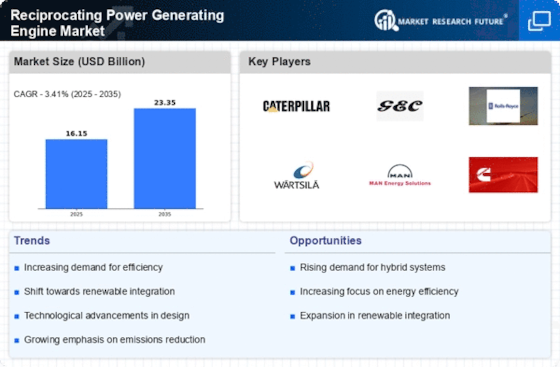

The Reciprocating Power Generating Engine Market is experiencing a notable transformation due to advancements in engine design and technology. Innovations such as improved fuel efficiency, reduced emissions, and enhanced reliability are driving the adoption of these engines across various sectors. For instance, the integration of digital technologies and IoT capabilities allows for real-time monitoring and predictive maintenance, which can significantly lower operational costs. Furthermore, the development of high-performance materials is enabling engines to operate at higher temperatures and pressures, thus increasing their efficiency. As a result, the market is projected to grow at a compound annual growth rate of approximately 5% over the next few years, reflecting the increasing demand for more efficient and environmentally friendly power generation solutions.