Consumer Awareness

Consumer awareness regarding the benefits of rechargeable batteries is steadily increasing, which appears to be a significant driver for the Rechargeable Batterie Market. As individuals become more informed about the environmental and economic advantages of using rechargeable batteries, their purchasing decisions are likely to reflect this knowledge. Surveys indicate that a growing percentage of consumers prefer rechargeable options due to their cost-effectiveness over time and reduced environmental impact. This shift in consumer behavior is expected to contribute to a market growth rate of approximately 12% annually. The heightened awareness among consumers suggests that the Rechargeable Batterie Market is poised for sustained expansion as more individuals opt for sustainable energy solutions.

Diverse Applications

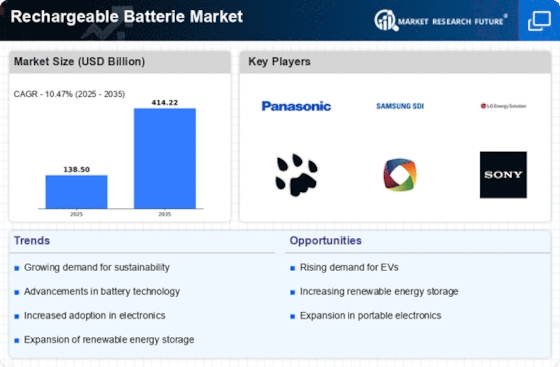

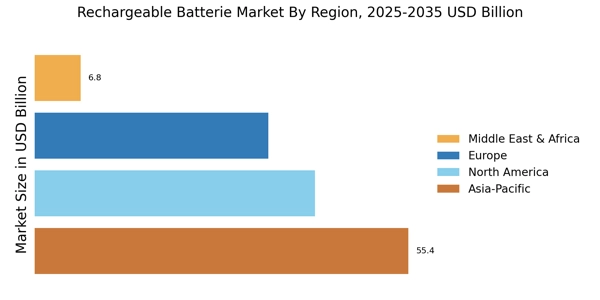

The versatility of rechargeable batteries is a key driver for the Rechargeable Batterie Market. These batteries are increasingly utilized across various sectors, including consumer electronics, electric vehicles, and renewable energy storage. The rise of electric vehicles, in particular, is propelling demand, as manufacturers seek efficient and long-lasting battery solutions. According to recent estimates, the electric vehicle segment alone is expected to account for over 30% of the rechargeable battery market by 2025. This diversification of applications suggests that the Rechargeable Batterie Market is not limited to a single sector but is expanding into multiple domains, thereby enhancing its growth potential.

Technological Innovations

Technological advancements are driving the Rechargeable Batterie Market forward at an unprecedented pace. Innovations in battery chemistry, such as lithium-sulfur and solid-state batteries, are enhancing energy density and safety. These developments are crucial as they address the limitations of traditional lithium-ion batteries, which have dominated the market. The introduction of fast-charging technologies is also reshaping consumer expectations, making rechargeable batteries more appealing for everyday use. Market data indicates that the demand for advanced battery technologies is expected to grow significantly, with projections suggesting a market size of over 80 billion USD by 2025. This indicates that technological innovations are not only enhancing performance but are also likely to redefine the competitive landscape of the Rechargeable Batterie Market.

Sustainability Initiatives

The increasing emphasis on sustainability appears to be a pivotal driver for the Rechargeable Batterie Market. As consumers and corporations alike prioritize eco-friendly practices, the demand for rechargeable batteries is likely to surge. This shift is evidenced by the growing number of regulations aimed at reducing waste and promoting recycling. For instance, many countries are implementing stricter guidelines on battery disposal, which encourages the adoption of rechargeable alternatives. The market for rechargeable batteries is projected to reach approximately 100 billion USD by 2026, reflecting a compound annual growth rate of around 15%. This trend suggests that sustainability initiatives are not merely a passing phase but a fundamental aspect of the Rechargeable Batterie Market's evolution.

Government Policies and Incentives

Government policies and incentives play a crucial role in shaping the Rechargeable Batterie Market. Many governments are implementing initiatives to promote the use of renewable energy and reduce reliance on fossil fuels, which often includes support for rechargeable battery technologies. Incentives such as tax breaks, subsidies, and grants for research and development are encouraging manufacturers to innovate and improve battery technologies. Recent data indicates that countries investing in battery production and recycling infrastructure are likely to see a significant increase in market growth. This supportive regulatory environment suggests that government actions are not only fostering innovation but are also essential for the long-term viability of the Rechargeable Batterie Market.