Certified Global Research Member

Key Questions Answered

- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

Why Choose Market Research Future?

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Covered Aspects:

| Report Attribute/Metric | Details |

|---|---|

| Market Opportunities | Rising demand for ready-to-eat meals among young consumers |

| Market Dynamics | Rising trend relating to the consumption of convenience food Increased in the per capita disposable income of consumers |

Ready to Eat Meals Market Highlights:

Global Ready-to-Eat Meals Market Overview

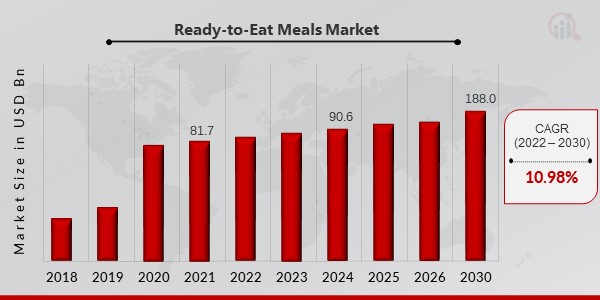

Ready-to-Eat Meals Market Size was valued at USD 81.7 billion in 2021. The ready-to-eat meals industry is projected to grow from USD 90.6 Billion in 2024 to USD 188.0 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 10.98% during the forecast period (2024 - 2030). Rising trends relating to convenience food consumption and the increase in consumers' per capita disposable income are the key ready-to-eat meal market drivers enhancing the market growth.

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Ready-to-Eat Meals Market Trends

- Growing demand for packaged foods to boost ready-to-eat meals market growth

As individuals seek higher-quality ingredients, greater variety, and quicker delivery, packed meal preferences are continuously shifting. This has increased demand for same-day delivery and ready-to-eat takeaways, which command higher prices. Two in five people in the U.K. consume packaged meals every week, and 88% of adults eat ready breakfasts and dinners or ready-to-cook items, according to Eating Better's Ready Meals 2020 Snapshot Survey. These patterns are positive for ready-to-eat market expansion.

Moreover, the trend toward more plant-based/vegan ingredients and sustainable packaging with less plastic and waste is changing how packaged food boxes are perceived. Brands are under increasing pressure to provide better items for the environment. For instance, Walki, a consumer and industrial packaging business, introduced a line of frozen and packed food trays in September 2021. These trays are said to be recyclable in paper streams. The Walki Pack Tray PET is one of the new trays; it has a thin PET lining that is regarded as a mono-material and may be recycled in paper streams.

Due to the rising demand for ready meals, the supply side of the ready-to-meal industry has also been evolving, forcing restaurants, hotels, and cafes to alter their business models. At the same time, this change presents fresh opportunities for businesses, including grocers, hypermarkets, and supermarkets. Important supermarkets like Walmart, Target, and Aldi have offered packaged breakfast and dinner items or worked with cloud kitchens. For instance, Finnair began selling its products in supermarkets in October 2020 when it introduced "Taste of Finnair" in K-Citymarket Tammisto, a grocery store in Vantaa, Finland. Therefore, the enhancement of restaurants, hotels, and cafes to further drove the ready-to-eat meals market CAGR ly in recent years.

However, to cater to the demand, there have been significant advances in product packaging, another factor driving the growth of the ready-to-eat meals market revenue.

Ready-to-Eat Meals Market Segment Insights

Ready-to-Eat Meals Type Insights

The ready-to-eat meals market segmentation, based on type, includes rice & noodles, salads, gravies & curries, pasta & pizzas, soups and others. The rice and noodles segment held the majority share in 2021, contributing to around ~30% of the ready-to-eat meals market revenue. This is primarily due to factors including the increase in the diversity of products and consumer knowledge of the introduction of organic ready-to-eat foods. Besides, the salads category is presumed to witness the fastest growth over the coming years. This is due to the increasing demand for healthy foods among millennials across the globe.

Ready-to-Eat Meals Distribution Channel Insights

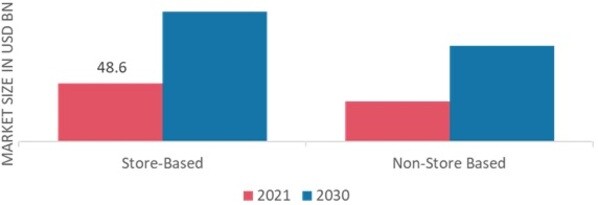

Figure 2: Ready-to-Eat Meals Market, by Distribution Channel, 2021 & 2030 (USD Million) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

The ready-to-eat meals market segmentation, based on distribution channel, includes store and non-store based. The store-based category is expected to dominate the growth of the ready-to-eat meals industry over the anticipated timeframe. Moreover, the store-based category is further bifurcated into supermarkets, hypermarkets, convenience stores, and others. In 2021, supermarkets and hypermarkets contributed the most to the ready-to-eat meals market. In industrialized nations like the U.K. and the U.S., ready meals are becoming more popular. Most supermarkets, hypermarkets, and convenience stores carry their selection of practical ready-to-eat items. For instance, independent retailer Jempson introduced a variety of prepared meals in its neighborhood kitchen in January 2021. These meals include lasagna, toad in the hole, fish pie, and chicken with honey and mustard.

Besides, the non-store-based category is projected to witness the highest growth in the anticipated timeframe due to rising demand for online distribution channels worldwide. Hence, rising demand for online distribution channels is projected to positively impacts the ready-to-eat meals market growth.

Ready-to-Eat Meals Regional Insights

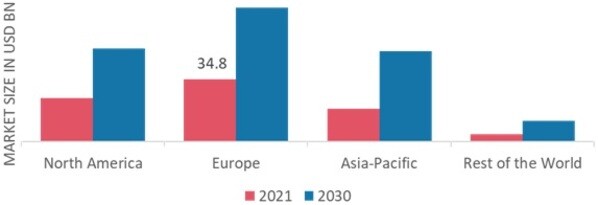

By Region, the study provides the ready-to-eat meals market insights into North America, Europe, Asia-Pacific and the Rest of the World. Europe ready-to-eat meals market accounted for USD 34.8 billion in 2021 and is presumed to exhibit a noteworthy CAGR growth during the study period. This is attributed to several variables, including the augmented popularity of convenience foods along with the availability of a wide variety of ready-to-eat meals. Moreover, the presence of well-known players in a European geographic area may also be a factor in the region's growth.

Further, the major countries studied in the ready-to-eat meals market report are: The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: READY-TO-EAT MEALS MARKET SHARE BY REGION 2021 (%) Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

North America, ready-to-eat meals market, accounts for the second-largest ready-to-eat meals market share. The region's product demand is driven by customers' changing food tastes due to rising health consciousness and worries about food safety. Additionally, pre-packaged vegan, gluten-free, and organic foods get a lot of value from consumer trust and perceptions of the items' healthfulness. The popularity of ready-to-eat meals is rising due to their mobility, convenience, and accessibility to new options. Further, the United States ready-to-eat meals market held the largest market share, and the Canadian ready-to-eat meals market was the fastest-growing market in the European region

The Asia-Pacific Ready-to-Eat Meals Market is expected to grow at the fastest CAGR from 2022 to 2030. The market is expanding due to rising consumer disposable income and increased awareness of ready-meal goods. Additionally, the demand for pre-packaged meals will benefit from rising living standards and quick industrialization in developing nations like India. Moreover, China ready-to-eat meals market held the largest market share, and the India ready-to-eat meals market is the fastest-growing market in the Asia-Pacific region.

Ready-to-Eat Meals Key Market Players & Competitive Insights

Major market players are investing ample money on research & development to grow their product lines, which is estimated to help the ready-to-eat meals market grow in the coming years. Ready-to-eat meals Market contributors are taking various planned initiatives to grow their footprint, with key market developments such as increased investments, contractual agreements, new product launches, mergers and acquisitions, and collaboration with other organizations. Participants in the ready-to-eat meals industry must offer lucrative items to expand and continue in a progressively competitive and increasing market environment.

One of the key business strategies accepted by manufacturers in the ready-to-eat meals industry to advantage clients and expand the market sector is to produce locally to reduce operating costs. In recent years, the ready-to-eat meals industry has provided products with some of the most significant benefits. The ready-to-eat meals market major player such as General Mills Inc., Premier Foods Plc, Unilever, Kerry Group, Conagra Foods Inc are working to increase the market demand by investing in R&D activities.

American multinational General Mills, Inc. produces and markets branded processed consumer foods distributed through retail outlets. The enterprise, which was established at Saint Anthony Falls in Minneapolis on the banks of the Mississippi River, first rose to prominence as a significant flour miller. In August 2022, Prepared meal kits were introduced by General Mills Inc. under the Betty Crocker, Old El Paso, Pillsbury, and Annie's Organic brands. It offers customers options for easy homemade recipes that are fully cooked and ready to eat.

Also, Nestlé S.A. is an international food and beverage processing conglomerate firm located in Vevey, Vaud, Switzerland. Some of the baby food, medical food, bottled water, breakfast cereals, coffee, tea, confections, dairy goods, ice cream, frozen foods, pet foods, and snacks are all manufactured by Nestlé. In August 2021, Freshly, the brand owned by Nestlé, just introduced its first line of vegan meals. The chef-prepared meal delivery service's new completely plant menu will feature six selections created to highlight plant-based dishes' health advantages and mouthwatering potential. The meals, which can be prepared in about three minutes, are influenced by a variety of cuisines and include Moroccan Herb Falafel Bowl with Garlicky Hummus & Toasted Quinoa, Indian-Spiced Chickpea Curry Bowl with Basmati Rice, Lentils & Veggies, Farmstead Baked Pasta with Melty Cashew Cheese & Seasonal Veggies, Creamy Buffalo Cauli Mac & Cheese with Garlic-Roa.

Key Companies in the ready-to-eat meals market include

- General Mills Inc.

- Premier Foods Plc

- Unilever

- Kerry Group

- Conagra Foods Inc.

- Associated British Foods Plc

- Tyson Foods Inc

- Greencore Group Plc

- Grupo Bimboamong others

Ready-to-Eat Meals Industry Developments

2021 A variety of trays for packed and frozen meals that are required to be recyclable in paper streams were developed in 2021 by the Walki-a company, which focuses on the customer and industrial packaging.

February 2021 To introduce 100% plant-based ready meals, online store The Vegan Kind teamed up with the creators of plant-based meat, "THIS." These include vegan chicken that is incredibly lifelike and is prepared with veggies, herbs, and spices.

February 2022 In the UK, a brand-new ready meal company called Kitchen Prep has debuted, delivering frozen gourmet pre-packaged meals that are nutritious. The pre-made dishes include spicy cod with zoodles, one-pot turkey chilli with rice, and spaghetti with beef and green beans in soy sauce. There is also a vegan selection, which features dishes like a spicy cauliflower chickpea rice bowl, sweet potato curry, and creamy leek risotto.

Ready-to-Eat Meals Market Segmentation

Ready-to-Eat Meals Type Outlook

- Rice and Noodles

- Salads

- Gravies and Curries

- Pasta and Pizzas

- Soups

- Others

Ready-to-Eat Meals Distribution Channel Outlook

- Store-based

- Non-store-based

Ready-to-Eat Meals Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America