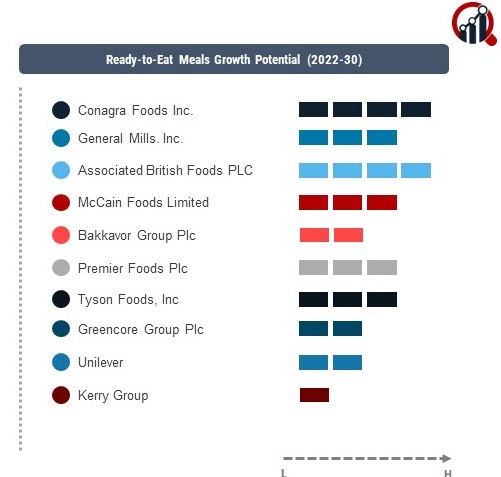

Top Industry Leaders in the Ready to Eat Meals Market

competitive landscape of the ready-to-eat meals market is characterized by a robust interplay of key players, each strategically maneuvering to establish and strengthen their foothold in this burgeoning sector. Prominent among these key players are Nestle S.A., Conagra Brands, Inc., Unilever PLC, The Kraft Heinz Company, and Bakkavor Group Limited

- General Mills Inc.

- Premier Foods Plc

- Unilever

- Kerry Group

- Conagra Foods Inc.

- Associated British Foods Plc

- Tyson Foods Inc

- Greencore Group Plc

- Grupo Bimboamong others

These industry leaders have solidified their positions through a combination of product innovation, strategic acquisitions, and a commitment to meeting the evolving needs of consumers seeking convenient and time-saving meal solutions.

Strategies Adopted:

adopted by these key players underscore the dynamic nature of the market, with a focus on product diversification, brand enhancement, and market expansion. Nestle S.A. has been a trailblazer in the ready-to-eat meals sector, consistently introducing new products and adapting to changing consumer preferences. Conagra Brands, Inc. has pursued an acquisition-driven strategy, expanding its product portfolio through strategic mergers to address a wider consumer base. Unilever PLC has prioritized sustainability in its ready-to-eat offerings, responding to the growing demand for eco-friendly and responsibly sourced products. The Kraft Heinz Company has capitalized on brand recognition, leveraging its established position to introduce innovative ready-to-eat meal options. Bakkavor Group Limited has excelled in customization, tailoring its offerings to meet diverse regional and consumer preferences.

Market Share Analysis Factors:

Market share analysis in the ready-to-eat meals industry is influenced by various factors, with product quality, brand recognition, and distribution capabilities playing key roles. The ability of key players to adapt to dietary trends, offer diverse cuisine options, and provide healthier alternatives directly impacts their market share. Additionally, efficient supply chain management, shelf space in retail outlets, and competitive pricing are critical components for securing and expanding market share. As the market matures, factors such as online presence and digital marketing strategies also contribute significantly to a company's competitive standing.

In the evolving landscape of the ready-to-eat meals market, new and emerging companies are making noteworthy strides, challenging the dominance of established players. Companies like Freshly and HelloFresh have carved out niches by focusing on subscription-based models for convenient and nutritious meals delivered directly to consumers. These emerging players often bring innovation and agility, disrupting traditional market dynamics with their unique business models and contemporary branding.

New & Emerging Companies:

Industry news and current investment trends reveal a collective effort among key players to address changing consumer preferences, invest in technology, and explore sustainable packaging options. Investments in research and development activities to introduce healthier, more diverse, and culturally relevant ready-to-eat options are prevalent. Additionally, there is a notable trend towards partnerships with e-commerce platforms, enhancing the accessibility of these products to consumers in the digital space. Strategic mergers and acquisitions continue to be a significant trend, allowing companies to expand their market reach and tap into complementary product categories.

Competitive Scenario:

The overall competitive scenario in the ready-to-eat meals market is characterized by a blend of established players consolidating their positions and emerging companies challenging traditional norms. The established players leverage their brand equity, extensive distribution networks, and economies of scale to maintain dominance. Meanwhile, the nimbleness and innovative approaches of emerging companies contribute to the overall dynamism of the market.

Recent Development

Recent developments indicate a growing emphasis on health and wellness in the ready-to-eat meals sector. Key players are responding to consumer demands for cleaner labels, transparent ingredient sourcing, and nutritional information. Companies are reformulating existing products or introducing new ones to cater to specific dietary needs, including vegetarian, vegan, and gluten-free options. Moreover, there is a discernible shift toward using sustainable and recyclable packaging materials, aligning with broader environmental concerns and consumer preferences.