Market Growth Projections

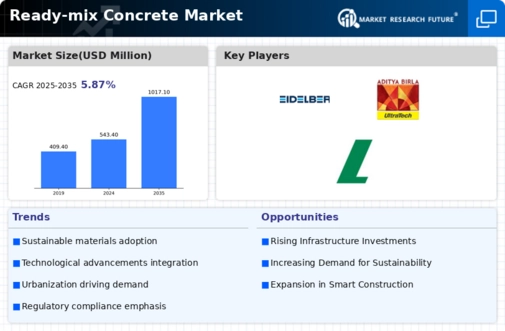

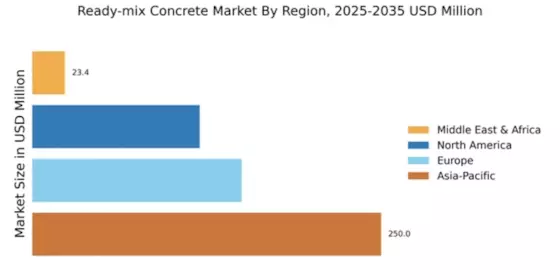

The Global Ready-mix Concrete Market Industry is poised for substantial growth, with projections indicating a market value of 543.4 USD Million in 2024 and an anticipated increase to 1017.1 USD Million by 2035. This growth trajectory suggests a robust compound annual growth rate (CAGR) of 5.86% from 2025 to 2035, reflecting the industry's resilience and adaptability in meeting the evolving demands of construction. Factors such as urbanization, infrastructure development, and technological advancements are expected to contribute significantly to this growth, positioning ready-mix concrete as a vital component in the global construction landscape.

Regulatory Support and Standards

Regulatory support and the establishment of standards play a crucial role in shaping the Global Ready-mix concrete market industry. Governments are implementing regulations that promote the use of high-quality construction materials, including ready-mix concrete, to ensure safety and durability in building projects. Compliance with these regulations often necessitates the use of ready-mix concrete, thereby driving demand. As countries continue to enhance their building codes and standards, the market is likely to benefit from increased adoption of ready-mix concrete in various construction applications.

Urbanization and Population Growth

Urbanization continues to be a driving force in the Global Ready-mix Concrete Market Industry. As populations migrate to urban areas, the demand for residential and commercial buildings rises sharply. This urban expansion necessitates the use of ready-mix concrete, which offers superior strength and durability for construction projects. The increasing need for housing, schools, and commercial spaces in rapidly growing cities is likely to propel the market forward. By 2035, the market is anticipated to reach 1017.1 USD Million, underscoring the critical role of ready-mix concrete in accommodating urban growth and development.

Infrastructure Development Initiatives

The Global Ready-mix Concrete Market Industry is experiencing a notable boost due to extensive infrastructure development initiatives worldwide. Governments are increasingly investing in transportation, energy, and urban infrastructure projects, which necessitate the use of ready-mix concrete for its efficiency and quality. For instance, various countries are undertaking large-scale road and bridge construction projects, which are projected to significantly increase the demand for ready-mix concrete. This trend is expected to contribute to the market's growth, with projections indicating a market value of 543.4 USD Million in 2024, reflecting the industry's pivotal role in supporting infrastructure advancements.

Technological Advancements in Production

Technological advancements in the production of ready-mix concrete are transforming the Global Ready-mix Concrete Market Industry. Innovations such as automated batching systems and improved mixing techniques enhance the efficiency and quality of concrete production. These advancements not only reduce waste but also ensure a more consistent product, which is crucial for large-scale construction projects. As construction companies increasingly adopt these technologies, the demand for ready-mix concrete is expected to rise. This trend aligns with the projected CAGR of 5.86% from 2025 to 2035, indicating a robust growth trajectory driven by technological improvements.

Sustainability and Eco-Friendly Practices

Sustainability is becoming a central theme in the Global Ready-mix Concrete Market Industry. With growing awareness of environmental issues, there is a shift towards eco-friendly construction materials and practices. Ready-mix concrete producers are increasingly incorporating recycled materials and adopting sustainable production methods to minimize their carbon footprint. This trend is likely to attract environmentally conscious consumers and businesses, thereby expanding the market. As sustainability becomes a priority in construction, the demand for ready-mix concrete that meets these criteria is expected to grow, further solidifying its position in the industry.