Sustainability Initiatives

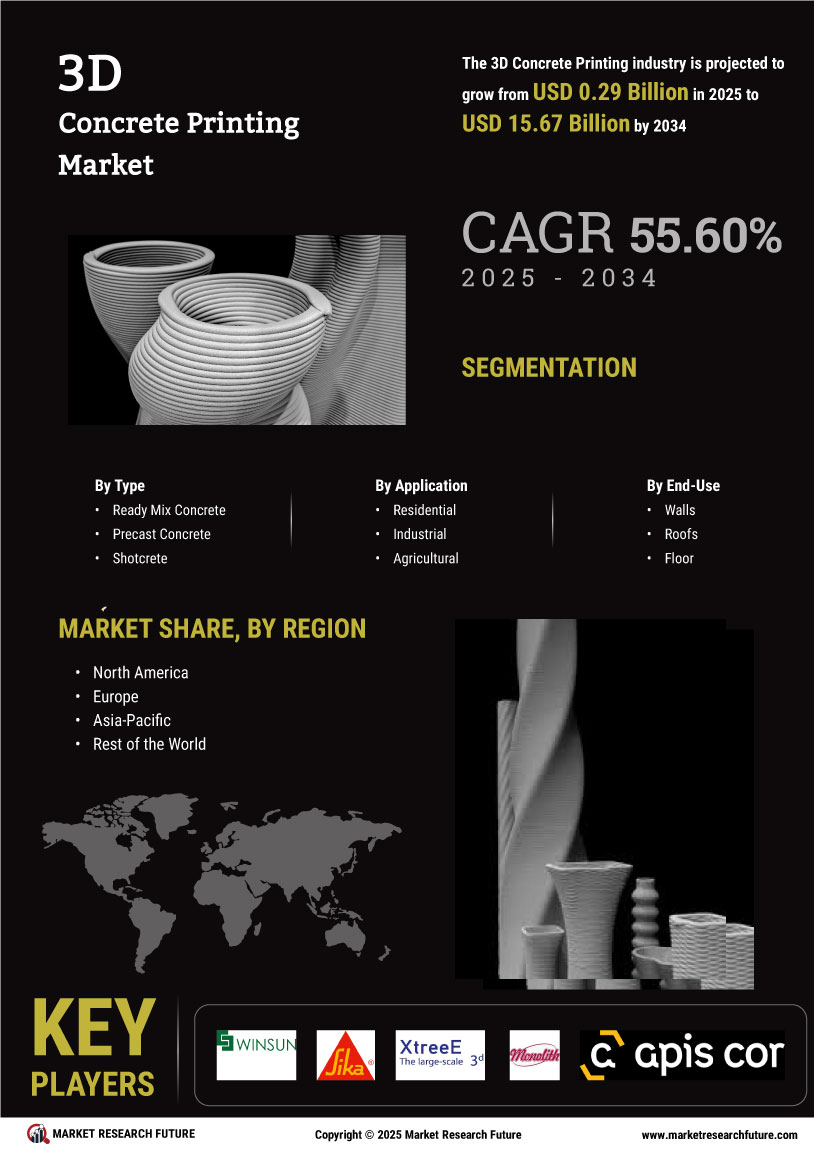

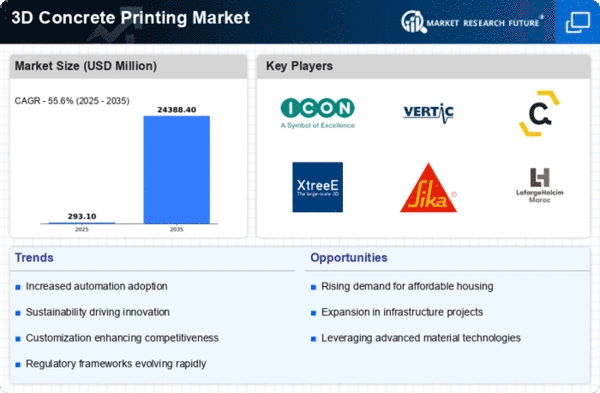

Sustainability is becoming a pivotal driver in the Global 3D Concrete Printing Market Industry as environmental concerns gain prominence. The ability to utilize recycled materials and reduce waste during construction aligns with global sustainability goals. Moreover, 3D concrete printing minimizes the carbon footprint associated with traditional construction methods. This shift towards eco-friendly practices is likely to attract investments and foster growth in the sector. As the market evolves, the emphasis on sustainable construction practices could lead to a compound annual growth rate of 55.48% from 2025 to 2035, reflecting a growing preference for environmentally responsible building solutions.

Technological Advancements

The Global 3D Concrete Printing Market Industry is experiencing rapid technological advancements that enhance the efficiency and capabilities of construction processes. Innovations in materials, such as high-performance concrete and additives, allow for more complex designs and improved structural integrity. For instance, the integration of robotics and automation in 3D printing processes reduces labor costs and construction time. As a result, the market is projected to grow from 0.19 USD Billion in 2024 to an astounding 24.4 USD Billion by 2035, indicating a robust demand for advanced construction technologies.

Cost Efficiency and Labor Reduction

Cost efficiency and labor reduction are vital factors influencing the Global 3D Concrete Printing Market Industry. The technology significantly lowers construction costs by minimizing material waste and reducing the need for extensive labor. Automated processes streamline production, allowing for faster project completion. This economic advantage is particularly appealing in regions facing labor shortages or high labor costs. As the industry continues to evolve, the potential for further cost savings may enhance the attractiveness of 3D concrete printing, thereby encouraging broader adoption across various construction sectors.

Customization and Design Flexibility

Customization and design flexibility are increasingly recognized as key advantages of the Global 3D Concrete Printing Market Industry. Unlike traditional construction methods, 3D printing allows for the creation of intricate designs and tailored structures that meet specific client needs. This capability not only enhances aesthetic appeal but also optimizes functionality. As architects and builders embrace this technology, the demand for customized solutions is likely to rise, further driving market growth. The ability to produce unique structures efficiently positions 3D concrete printing as a preferred choice in modern construction.

Urbanization and Infrastructure Development

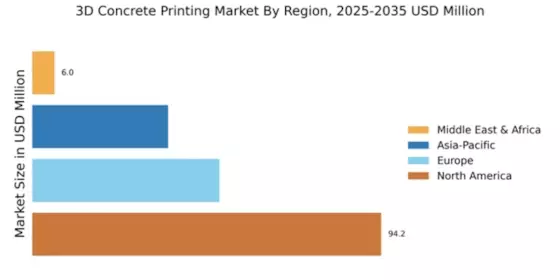

The ongoing trend of urbanization and the need for infrastructure development are significant drivers of the Global 3D Concrete Printing Market Industry. Rapid population growth in urban areas necessitates innovative construction solutions to meet housing and infrastructure demands. Governments worldwide are investing in smart city initiatives, which often incorporate advanced construction technologies like 3D concrete printing. This trend is expected to propel the market forward, as urban planners and developers seek efficient and cost-effective methods to construct residential and commercial buildings, thereby contributing to the projected market growth.