Sustainability Initiatives

The Cement Market is increasingly influenced by sustainability initiatives aimed at reducing carbon emissions and promoting eco-friendly practices. As governments and organizations prioritize environmental concerns, cement manufacturers are adopting greener production methods. This includes the use of alternative fuels and raw materials, which can potentially lower the carbon footprint of cement production. For instance, the incorporation of industrial by-products such as fly ash and slag not only enhances the sustainability of the Cement Market but also improves the performance characteristics of the final product. Furthermore, regulatory frameworks are evolving to support these initiatives, compelling companies to innovate and invest in sustainable technologies. The shift towards sustainability is likely to reshape competitive dynamics within the Cement Market, as firms that embrace these changes may gain a significant advantage in an increasingly eco-conscious marketplace.

Technological Advancements

Technological advancements are reshaping the Cement Market, enhancing production efficiency and product quality. Innovations such as automation, artificial intelligence, and advanced data analytics are being integrated into manufacturing processes, leading to improved operational performance. For instance, the adoption of smart manufacturing techniques allows for real-time monitoring and optimization of production lines, which can reduce waste and energy consumption. Additionally, the development of high-performance cement products, such as self-healing and ultra-high-performance concrete, is expanding the application scope of cement in construction. These advancements not only meet the evolving demands of the construction sector but also position the Cement Market for future growth. As technology continues to evolve, companies that invest in research and development may gain a competitive edge, potentially transforming their market presence.

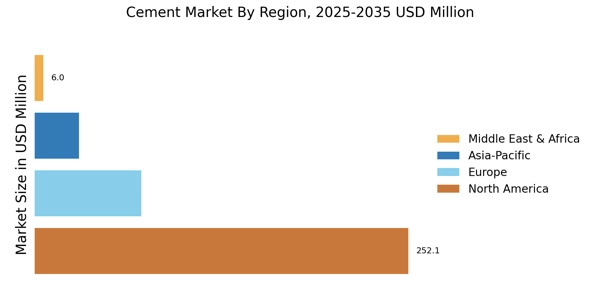

Economic Growth and Investment

Economic growth and investment trends are pivotal drivers of the Cement Market, as they directly correlate with construction activity and infrastructure development. In periods of economic expansion, increased investment in residential, commercial, and public infrastructure projects typically leads to heightened demand for cement. Recent forecasts indicate that construction spending is expected to rise, particularly in developing regions where urbanization is accelerating. This surge in investment not only stimulates the Cement Market but also encourages innovation and competition among manufacturers. Additionally, public-private partnerships are becoming more prevalent, further bolstering investment in infrastructure projects. As economies recover and grow, the Cement Market is likely to experience sustained demand, positioning it favorably for future growth opportunities.

Regulatory Frameworks and Standards

The Cement Market is significantly influenced by regulatory frameworks and standards that govern production practices and environmental compliance. Governments worldwide are implementing stricter regulations aimed at reducing emissions and promoting sustainable practices within the construction sector. These regulations often require cement manufacturers to adopt cleaner technologies and improve energy efficiency. Compliance with these standards can be challenging, yet it also presents opportunities for innovation and differentiation in the Cement Market. Companies that proactively align with regulatory requirements may enhance their reputation and marketability. Furthermore, the establishment of international standards for cement quality and performance is likely to facilitate trade and competition, shaping the dynamics of the Cement Market. As regulations evolve, firms must remain agile and responsive to maintain compliance and capitalize on emerging opportunities.

Urbanization and Infrastructure Development

Urbanization continues to be a driving force in the Cement Market, as rapid population growth in urban areas necessitates extensive infrastructure development. The demand for residential, commercial, and industrial buildings is surging, leading to increased consumption of cement. According to recent data, the construction sector is projected to grow at a compound annual growth rate of approximately 5% over the next few years, significantly impacting the Cement Market. Governments are investing heavily in infrastructure projects, including roads, bridges, and public transportation systems, which further fuels the demand for cement. This trend is particularly pronounced in emerging economies, where urbanization rates are accelerating. As cities expand and modernize, the Cement Market is poised to benefit from the ongoing need for durable and resilient construction materials.