Growing Awareness and Education

Growing awareness and education regarding rare hemophilia factors are pivotal in driving the Global Rare Hemophilia Factor Market Industry. Increased educational initiatives by healthcare organizations and advocacy groups are informing both patients and healthcare professionals about the complexities of rare hemophilia. This heightened awareness is likely to lead to earlier diagnosis and treatment initiation, positively impacting patient outcomes. As more individuals become informed about their conditions, the demand for effective therapies is expected to rise, further propelling market growth in the coming years.

Government Initiatives and Funding

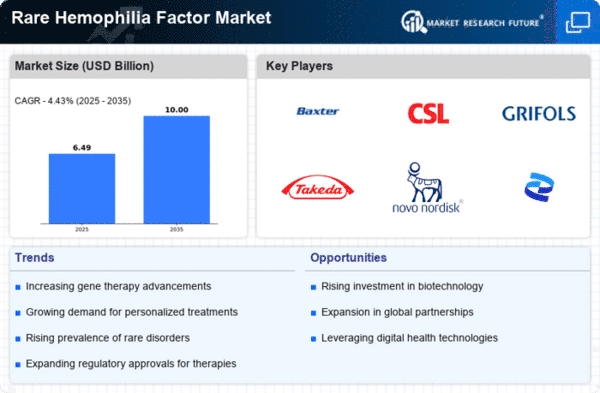

Government initiatives and funding play a crucial role in shaping the Global Rare Hemophilia Factor Market Industry. Various health authorities are implementing programs aimed at improving diagnosis, treatment accessibility, and patient care for rare hemophilia factors. Increased funding for research and development is likely to foster innovation in treatment options. For instance, public health campaigns are raising awareness about rare hemophilia, which could lead to earlier diagnosis and intervention. This supportive environment is expected to facilitate market growth, aligning with the projected CAGR of 4.43% from 2025 to 2035.

Advancements in Treatment Modalities

Innovations in treatment modalities for rare hemophilia factors are significantly influencing the Global Rare Hemophilia Factor Market Industry. New therapies, including gene therapy and extended half-life products, are emerging, offering improved efficacy and patient compliance. These advancements not only enhance the quality of life for patients but also contribute to market growth. As the industry evolves, the introduction of novel therapies is expected to attract investments, potentially increasing the market size to 10 USD Billion by 2035. The ongoing research and development efforts indicate a promising future for treatment options.

Rising Demand for Personalized Medicine

The shift towards personalized medicine is becoming increasingly prominent within the Global Rare Hemophilia Factor Market Industry. Tailored treatment approaches that consider individual patient profiles are gaining traction, leading to improved therapeutic outcomes. This trend is particularly relevant for rare hemophilia factors, where standard treatments may not be effective for all patients. As healthcare providers adopt personalized strategies, the demand for specialized therapies is expected to rise. This evolution in treatment paradigms may contribute to the market's expansion, aligning with the anticipated growth trajectory over the next decade.

Increasing Prevalence of Rare Hemophilia Factors

The Global Rare Hemophilia Factor Market Industry is witnessing a notable rise in the prevalence of rare hemophilia factors. As awareness and diagnosis improve, more patients are identified with conditions such as Factor VII and Factor X deficiencies. This increase in diagnosed cases is projected to drive market growth, with the market expected to reach 6.21 USD Billion in 2024. The growing patient population necessitates the development of specialized treatments, thereby creating opportunities for pharmaceutical companies to innovate and expand their product offerings.