Rising Prevalence of Hemophilia

The increasing prevalence of hemophilia is a primary driver for the Hemophilia Gene Therapy Market. It is estimated that hemophilia affects approximately 1 in 5,000 male births, leading to a significant patient population in need of effective treatments. As awareness of the condition grows, more individuals are being diagnosed, which in turn drives demand for innovative therapies. The rising number of patients with hemophilia creates a substantial market opportunity for gene therapy solutions, as traditional treatments often fall short in providing long-term relief. This trend suggests that the Hemophilia Gene Therapy Market is poised for growth, as healthcare providers and patients alike seek more effective and durable treatment options.

Increased Awareness and Education

There is a growing awareness and education surrounding hemophilia and its treatment options, which serves as a catalyst for the Hemophilia Gene Therapy Market. Healthcare professionals and patients are becoming more informed about the benefits of gene therapy, leading to increased demand for these advanced treatment modalities. Educational initiatives and advocacy efforts are helping to demystify gene therapy, making it a more accepted option among patients and providers. This heightened awareness is likely to drive market growth, as more individuals seek out gene therapy solutions for hemophilia, thereby expanding the reach of the Hemophilia Gene Therapy Market.

Advancements in Gene Editing Technologies

Recent advancements in gene editing technologies, such as CRISPR and AAV-based delivery systems, are propelling the Hemophilia Gene Therapy Market forward. These technologies enable precise modifications to the genetic material responsible for hemophilia, offering the potential for curative therapies. The ability to deliver genes effectively into target cells has shown promise in clinical trials, with some therapies demonstrating the potential to provide long-lasting effects after a single administration. As these technologies continue to evolve, they are likely to enhance the efficacy and safety profiles of gene therapies, thereby attracting investment and interest in the Hemophilia Gene Therapy Market.

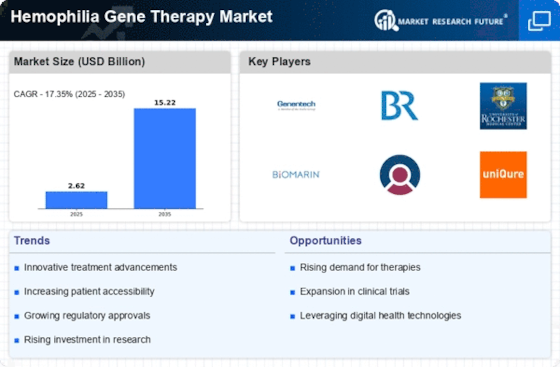

Growing Investment in Rare Disease Research

The increasing investment in research and development for rare diseases, including hemophilia, is a significant driver for the Hemophilia Gene Therapy Market. Pharmaceutical companies and biotech firms are recognizing the potential profitability of developing therapies for rare conditions, leading to a surge in funding and resources allocated to hemophilia research. This trend is evidenced by the growing number of clinical trials and partnerships aimed at developing innovative gene therapies. As more stakeholders enter the market, competition is likely to intensify, which could lead to accelerated advancements in treatment options within the Hemophilia Gene Therapy Market.

Regulatory Support for Innovative Therapies

Regulatory bodies are increasingly supportive of innovative therapies, which is beneficial for the Hemophilia Gene Therapy Market. Initiatives aimed at expediting the approval process for gene therapies are becoming more common, allowing for faster access to potentially life-changing treatments for patients. This regulatory environment encourages companies to invest in the development of gene therapies for hemophilia, as the pathway to market becomes clearer and more efficient. The favorable regulatory landscape is likely to stimulate growth in the Hemophilia Gene Therapy Market, as it reduces barriers to entry and fosters innovation.