North America : Market Leader in Services

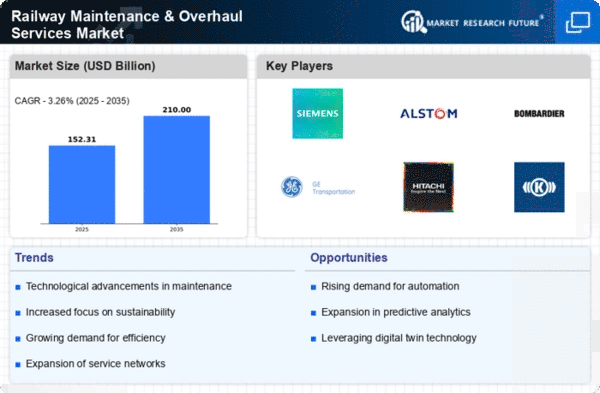

North America holds a commanding 60.0% share of the Railway Maintenance & Overhaul Services Market, driven by robust infrastructure investments and a growing emphasis on safety regulations. The region's demand is bolstered by the increasing need for modernization of aging rail systems and the adoption of advanced technologies. Regulatory support from government initiatives further catalyzes market growth, ensuring compliance with safety and operational standards. The competitive landscape is characterized by key players such as GE Transportation, Siemens, and Bombardier, who are actively engaged in enhancing service offerings. The U.S. and Canada lead the market, with significant investments in rail infrastructure. The presence of established companies fosters innovation and efficiency, positioning North America as a hub for railway service excellence.

Europe : Innovative Rail Solutions Hub

Europe, with a market share of 40.0%, is witnessing significant growth in the Railway Maintenance & Overhaul Services Market, driven by technological advancements and sustainability initiatives. The European Union's commitment to enhancing rail transport efficiency and reducing carbon emissions has led to increased investments in maintenance services. Regulatory frameworks, such as the European Railway Safety Directive, further support this growth by mandating high safety standards and operational efficiency. Leading countries like Germany, France, and the UK are at the forefront of this market, with major players such as Alstom and Siemens driving innovation. The competitive landscape is marked by collaborations and partnerships aimed at enhancing service delivery. The focus on digitalization and smart maintenance solutions positions Europe as a leader in the railway services sector.

Asia-Pacific : Emerging Market Potential

Asia-Pacific, holding a 35.0% market share, is rapidly emerging as a key player in the Railway Maintenance & Overhaul Services Market. The region's growth is fueled by urbanization, increasing investments in rail infrastructure, and government initiatives aimed at enhancing public transport systems. Countries like China and India are leading the charge, with substantial funding allocated for railway upgrades and maintenance services, driven by the need for efficient transportation solutions. The competitive landscape features major players such as Hitachi Rail and Bombardier, who are expanding their presence in the region. The focus on modernization and safety compliance is evident, with governments pushing for advanced maintenance technologies. As the demand for efficient rail services grows, Asia-Pacific is poised for significant market expansion in the coming years.

Middle East and Africa : Developing Rail Infrastructure

The Middle East & Africa region, with a market share of 12.5%, presents unique growth opportunities in the Railway Maintenance & Overhaul Services Market. The region is witnessing increased investments in rail infrastructure, driven by urbanization and economic diversification efforts. Governments are prioritizing rail transport as a sustainable solution to address growing urban mobility challenges, supported by various regulatory frameworks aimed at enhancing safety and efficiency. Countries like South Africa and the UAE are leading the way in rail development, with significant projects underway. The competitive landscape includes key players such as Knorr-Bremse and Thales Group, who are focusing on innovative maintenance solutions. As the region continues to develop its rail networks, the demand for maintenance services is expected to rise, creating a favorable market environment.