North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Railway Power Supply Equipment Repair and Maintenance Market, holding a market size of $2.6 billion in 2025. Key growth drivers include significant investments in infrastructure, a push for modernization, and stringent safety regulations. The demand for efficient and reliable railway systems is further fueled by increasing freight and passenger traffic, alongside government initiatives aimed at enhancing rail connectivity.

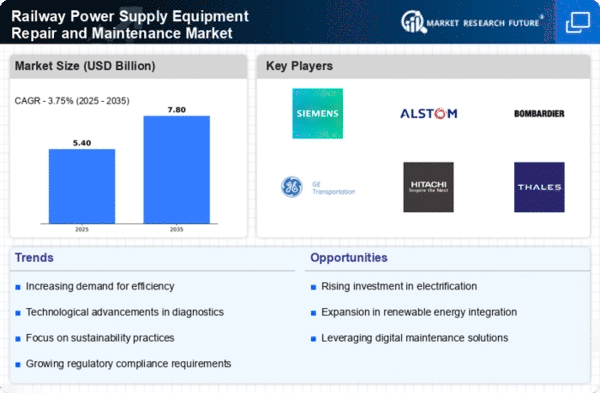

The competitive landscape is characterized by major players such as GE Transportation, Siemens, and Bombardier, which are actively involved in innovative solutions and service offerings. The U.S. and Canada are the leading countries, with a robust network of railways and a focus on sustainable practices. The presence of established companies ensures a dynamic market, fostering advancements in technology and service efficiency.

Europe : Regulatory Framework Driving Growth

Europe's Railway Power Supply Equipment Repair and Maintenance Market is projected to reach $1.5 billion by 2025, driven by a strong regulatory framework and a commitment to sustainable transport solutions. The European Union's Green Deal and various national initiatives are catalyzing investments in rail infrastructure, enhancing safety and efficiency. The demand for electrification and modernization of existing rail systems is also a significant growth factor, as countries aim to reduce carbon emissions and improve service reliability.

Leading countries in this region include Germany, France, and the UK, where major players like Alstom and Siemens are heavily invested. The competitive landscape is marked by collaborations and partnerships aimed at technological advancements. The presence of a well-established supply chain and skilled workforce further strengthens the market position of these companies, ensuring continued growth and innovation.

Asia-Pacific : Emerging Market with High Potential

The Asia-Pacific region is witnessing rapid growth in the Railway Power Supply Equipment Repair and Maintenance Market, projected to reach $1.3 billion by 2025. Key drivers include urbanization, increasing population, and government initiatives to expand railway networks. Countries like India and China are investing heavily in rail infrastructure, focusing on modernization and electrification to meet rising demand for efficient transport solutions. Regulatory support is also enhancing market dynamics, promoting safety and sustainability in rail operations.

China and India are the leading countries in this region, with significant contributions from companies like Hitachi and Mitsubishi Electric. The competitive landscape is evolving, with local players emerging alongside established global firms. This dynamic environment fosters innovation and collaboration, ensuring that the region remains a focal point for railway advancements and maintenance services.

Middle East and Africa : Developing Market with Opportunities

The Middle East and Africa region is gradually developing its Railway Power Supply Equipment Repair and Maintenance Market, expected to reach $0.8 billion by 2025. The growth is driven by increasing investments in rail infrastructure, particularly in countries like South Africa and the UAE, where governments are prioritizing transport modernization. The demand for efficient rail systems is rising, supported by urbanization and economic diversification efforts, which are crucial for regional development.

South Africa and the UAE are leading the way, with key players like ABB and Knorr-Bremse establishing a presence. The competitive landscape is characterized by a mix of local and international firms, fostering a collaborative environment for innovation. As the region continues to invest in rail infrastructure, opportunities for repair and maintenance services are expected to expand significantly, attracting further investment and expertise.