Focus on Safety and Compliance

Safety remains a paramount concern within the Railway Maintenance Machinery Market, as regulatory bodies impose stringent compliance standards. The increasing emphasis on safety protocols is driving the demand for advanced maintenance machinery that can effectively monitor and address potential hazards. Recent statistics indicate that rail accidents have decreased by 20% over the past decade due to improved maintenance practices and machinery. This trend underscores the importance of investing in state-of-the-art equipment that adheres to safety regulations. As rail operators strive to maintain compliance and enhance safety measures, the Railway Maintenance Machinery Market is poised for growth, with a focus on innovative solutions that prioritize safety and reliability.

Growing Demand for Efficient Operations

The Railway Maintenance Machinery Market is witnessing an increasing demand for efficient operations, driven by the need to minimize downtime and enhance service reliability. Rail operators are increasingly adopting advanced maintenance machinery to streamline their operations and reduce operational costs. Data suggests that the adoption of automated maintenance solutions can lead to a 30% reduction in maintenance time, thereby improving overall efficiency. This trend is further supported by the rising expectations of passengers for timely and reliable services. Consequently, the Railway Maintenance Machinery Market is likely to see a surge in demand for innovative solutions that facilitate proactive maintenance and ensure the smooth functioning of rail networks.

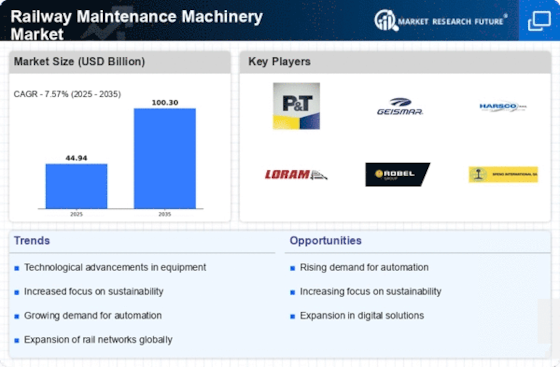

Increasing Investment in Infrastructure

The Railway Maintenance Machinery Market is experiencing a surge in investment as governments and private entities prioritize infrastructure development. This trend is driven by the need to modernize aging rail networks and enhance operational efficiency. According to recent data, investments in railway infrastructure are projected to reach USD 200 billion by 2026, indicating a robust growth trajectory. This influx of capital is likely to stimulate demand for advanced maintenance machinery, which is essential for ensuring the reliability and safety of rail operations. As countries strive to improve their transportation systems, the Railway Maintenance Machinery Market stands to benefit significantly from these investments, fostering innovation and technological advancements in maintenance practices.

Environmental Sustainability Initiatives

The Railway Maintenance Machinery Market is increasingly aligned with environmental sustainability initiatives as stakeholders seek to reduce their carbon footprint. The shift towards eco-friendly maintenance practices is prompting the adoption of machinery that utilizes renewable energy sources and minimizes waste. Data shows that the railway sector aims to achieve a 50% reduction in greenhouse gas emissions by 2030, which necessitates the use of sustainable maintenance solutions. This growing focus on sustainability is likely to drive innovation within the Railway Maintenance Machinery Market, as manufacturers develop equipment that meets these environmental standards while maintaining operational efficiency.

Technological Innovations in Maintenance Solutions

The Railway Maintenance Machinery Market is significantly influenced by technological innovations that enhance maintenance solutions. The integration of IoT, AI, and machine learning into maintenance practices is revolutionizing the industry. These technologies enable predictive maintenance, allowing operators to anticipate equipment failures and schedule timely interventions. Recent studies indicate that predictive maintenance can reduce maintenance costs by up to 25%, highlighting its potential impact on the Railway Maintenance Machinery Market. As technology continues to evolve, the demand for sophisticated maintenance machinery that incorporates these innovations is expected to rise, driving growth and efficiency in railway operations.