Cost-Effectiveness

Cost considerations are increasingly influencing the Pultrusion Products Market. Pultruded composites, while initially perceived as premium materials, offer long-term savings due to their durability and low maintenance requirements. Industries are recognizing that the initial investment in pultruded products can lead to reduced lifecycle costs, making them an attractive option. For example, in the construction sector, the longevity of pultruded materials can significantly lower replacement and repair expenses over time. Additionally, advancements in manufacturing processes are likely to reduce production costs, further enhancing the economic appeal of these products. Market data suggests that the cost-effectiveness of pultruded materials is a key factor driving their adoption, particularly in sectors where budget constraints are prevalent. As a result, the Pultrusion Products Market is expected to grow as more companies seek cost-efficient solutions.

Regulatory Support

Regulatory frameworks are increasingly favoring the use of advanced materials, which serves as a driver for the Pultrusion Products Market. Governments and regulatory bodies are implementing standards that promote the use of lightweight, durable, and sustainable materials in various applications. This regulatory support is particularly evident in the construction and automotive sectors, where compliance with safety and environmental standards is paramount. For instance, regulations that mandate the use of fire-resistant materials in construction are likely to boost the demand for pultruded composites, which can meet these stringent requirements. Furthermore, incentives for using sustainable materials may encourage manufacturers to adopt pultruded products. As these regulations evolve, they are expected to create a favorable environment for the Pultrusion Products Market, potentially leading to increased market penetration and growth.

Technological Innovations

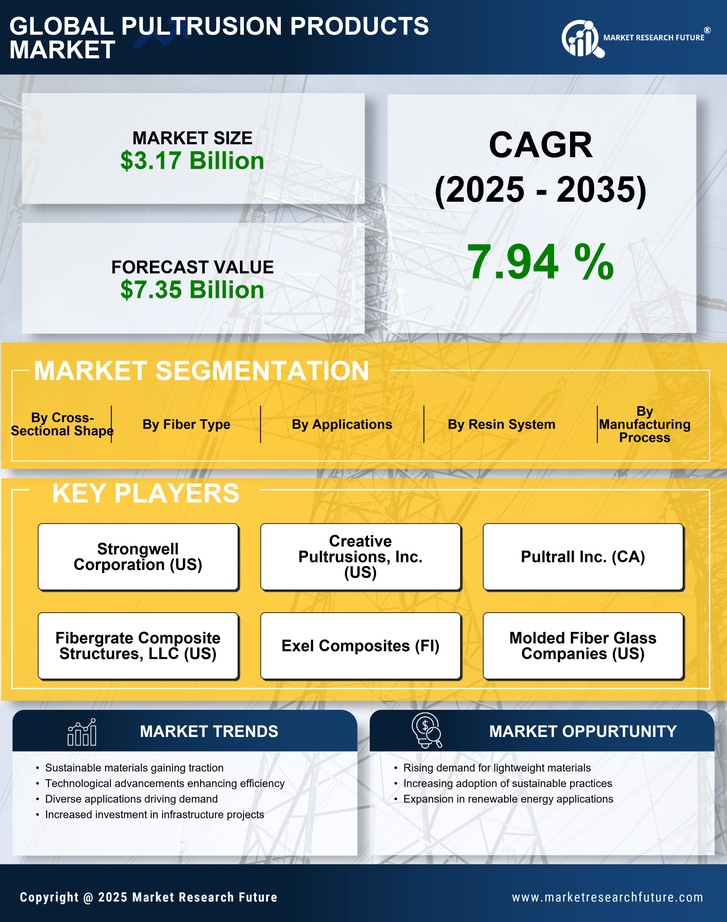

Technological advancements play a crucial role in shaping the Pultrusion Products Market. Innovations in manufacturing processes, such as automated pultrusion techniques, have enhanced production efficiency and product quality. These advancements allow for the creation of complex shapes and sizes, catering to diverse industry needs. Moreover, the integration of smart technologies, such as IoT and AI, into the pultrusion process is likely to optimize operations and reduce costs. According to recent data, the market for advanced pultrusion technologies is projected to grow at a compound annual growth rate of approximately 6% over the next five years. This growth indicates a robust interest in enhancing the capabilities of pultruded products, making them more appealing to manufacturers and end-users alike. As a result, the Pultrusion Products Market is expected to witness significant transformations driven by these technological innovations.

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the Pultrusion Products Market. As industries strive to reduce their carbon footprints, the demand for eco-friendly materials has surged. Pultruded composites, known for their durability and lightweight properties, align well with these sustainability goals. For instance, the construction sector is increasingly adopting pultruded products for structural applications, as they offer longevity and require less maintenance compared to traditional materials. This shift not only enhances energy efficiency but also contributes to waste reduction. Furthermore, regulatory frameworks are evolving to support sustainable practices, which may further bolster the adoption of pultruded materials across various sectors. The Pultrusion Products Market is thus positioned to benefit from this growing trend towards environmentally responsible manufacturing.

Diverse Industry Applications

The versatility of pultruded products is a significant driver for the Pultrusion Products Market. These materials find applications across various sectors, including construction, automotive, aerospace, and electrical industries. For instance, in the construction sector, pultruded composites are utilized for structural components, offering strength and resistance to corrosion. In the automotive industry, lightweight pultruded materials contribute to fuel efficiency and performance. Recent market analysis indicates that the construction sector accounts for nearly 40% of the total demand for pultruded products, highlighting the material's critical role in modern infrastructure projects. This broad applicability not only enhances market growth but also encourages innovation in product development. As industries continue to explore new applications for pultruded materials, the Pultrusion Products Market is likely to expand further, driven by the need for specialized solutions.