Rising Demand for Customization

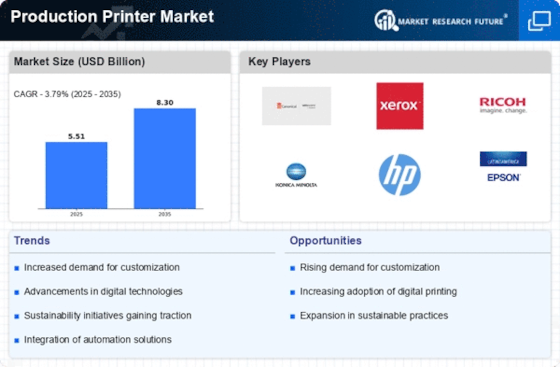

The Production Printer Market is experiencing a notable increase in demand for customized printing solutions. Businesses are increasingly seeking personalized products to enhance customer engagement and brand loyalty. This trend is particularly evident in sectors such as packaging, where tailored designs can significantly impact consumer choices. According to recent data, the customization segment is projected to grow at a compound annual growth rate of approximately 7% over the next five years. This shift towards individualized offerings is compelling manufacturers to innovate and adapt their production capabilities, thereby driving growth within the Production Printer Market.

Expansion of Print Service Providers

The expansion of print service providers is a significant factor influencing the Production Printer Market. As businesses seek to outsource their printing needs, the demand for specialized print service providers is on the rise. These providers offer a range of services, from design to production, catering to diverse client requirements. Market data suggests that the number of print service providers is projected to increase by 12% over the next few years, reflecting the growing trend of outsourcing. This expansion not only enhances competition but also drives innovation within the Production Printer Market, as providers strive to differentiate themselves through quality and service offerings.

Growth of E-commerce and Online Retail

The rise of e-commerce and online retail is significantly influencing the Production Printer Market. As more businesses transition to digital platforms, the need for effective packaging and promotional materials has surged. This trend is particularly pronounced in the retail sector, where visually appealing packaging can enhance product visibility and attract consumers. Recent statistics suggest that the e-commerce sector is anticipated to grow by over 20% in the coming years, thereby driving demand for production printers that can efficiently produce high-quality materials. This shift presents a lucrative opportunity for manufacturers within the Production Printer Market to expand their offerings.

Technological Advancements in Printing

Technological innovations are playing a pivotal role in shaping the Production Printer Market. The advent of high-speed inkjet and digital printing technologies has revolutionized production processes, enabling faster turnaround times and improved print quality. These advancements allow businesses to meet the increasing demands for short-run printing and quick delivery. Furthermore, the integration of advanced software solutions enhances workflow efficiency, reducing operational costs. Market data indicates that the adoption of these technologies is expected to increase by 15% annually, reflecting the industry's commitment to staying competitive and responsive to market needs.

Focus on Sustainability and Eco-friendly Practices

Sustainability has emerged as a critical driver in the Production Printer Market. Companies are increasingly prioritizing eco-friendly practices, including the use of recyclable materials and sustainable inks. This shift is not only a response to consumer demand for environmentally responsible products but also aligns with regulatory pressures aimed at reducing carbon footprints. Market analysis indicates that the sustainable printing segment is expected to grow by approximately 10% annually, as businesses seek to enhance their corporate social responsibility profiles. This focus on sustainability is prompting manufacturers to innovate and develop greener production processes within the Production Printer Market.