Research Methodology on Process Analyzer Market

The research methodology employed for the preparation of this report is based on extensive primary and secondary research incorporating inputs from industry experts and key participants of the Process Analyzer market. The data obtained from primary and secondary research is validated through a market survey that encompasses industry experts' opinions, major participants' opinions, and industry surveys gathered through valid contacts such as corporate sources, monthly magazines, trade journals, and industry body databases.

The research process starts with a study of the competitive environment and industry trends from secondary sources such as company reports, SEC filings, investment platforms, business journals, Factiva, Ovum, Global Research, Statista, Gartner, etc. This is followed by the primary research wherein the analyst undertakes interviews with industry leaders, and government agencies, and participates in publications from across the world. The company also collects information from industry bodies and associations.

The next step involves data mining of the primary and secondary sources. The collected data is analysed to evaluate the impact of the overall market and segments on the market's dynamics. The collected data is structured and organized into tables, sections and subsections to help the analyst draw insights and conclusions to aid the market foresight. To further validate and triangulate the collected data, a chapter on qualitative analysis is conducted. This chapter involves a PESTLE, Porter's Five Forces, and SWOT analysis.

At the end of this analysis and extrapolation, the analyst draws out the key takeaways and the report is structured. The report also offers a market estimation and forecasts taking into consideration all the unfavourable and favourable scenarios.

Research Design

The research design of our Process Analyzer Market report has been structured to provide reliable and comprehensive details about the market to all stakeholders in the industry. The focus of the research design is to reveal the growth strategies of all market participants, along with the revenue potential of different market segments.

For this report, both primary and secondary research was conducted, to gather insights and provide an all-encompassing analysis of the market. The primary research methodologies employed in the study were one-on-one discussions with industry experts and surveys conducted with knowledgeable professionals in the field. This helps to understand the market scenario in-depth and gain valuable insights into the overall market.

Moreover, secondary research techniques such as data mining and analysis helped to gain the required data and information from reliable industry sources such as magazines, books, databases, and white papers. Additionally, participants' strategies helped to gain further insights into their strategies and understand the competition in the Process Analyzer Market.

The research process included gathering valuable data and insights from all the stakeholders and market participants. This data was then analysed to draw out relevant information, which was further verified by industry experts and key players. The collected data was structured and organised into different sections of the report to facilitate easier understanding and interpretation.

Data Sources and Validation

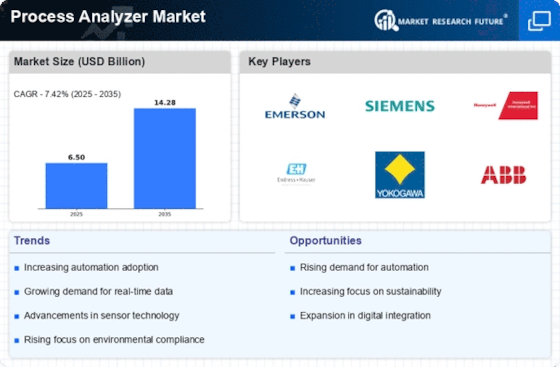

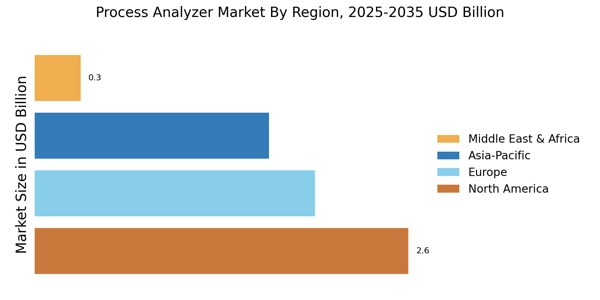

Data obtained during primary and secondary research for the Process Analyzer Market is put through a meticulous validation process that ensures accuracy and completeness. The validation process is conducted using industry standards such as revenues, market capitalisation, volumes and share prices of players in the industry, revenue generated from product sales, market forecast (2023 to 2030), etc. The report takes into account the market dynamics and trends for each of the segments and geographical regions.

A panel of experts from the Process Analyzer Market was involved in the data collection, verification and validation process. The data from the primary research was verified using the sources from the secondary research. The secondary research was conducted through reliable industry databases and other sources such as Global Research, Statista, Gartner, Factiva, Ovum and company information.

Market Forecasts and Estimations

To accurately forecast and estimate the Process Analyzer Market, researchers employed the combination of stringent secondary research, primary research and in-depth forecasting models. This was done to comprehend industry dynamics and elucidate the relationships between market segments.

The forecasting models used in the compilation of the market report are based on historical growth patterns and are further validated using inputs from industry experts and leaders. The models also took into account current market dynamics and the ever-changing competitive landscape. This further helped to accurately estimate the potential of the market, and the foreseeable risks, opportunities and opportunities.

The market estimates and forecasts provided in the research report are inclusive of the CAGR for each segment, the market size, the possible opportunities and threats, and the emerging trends. The market aggregation, segmentation and forecast presented in the report are further analysed and validated by industry experts to offer realistic market estimations.