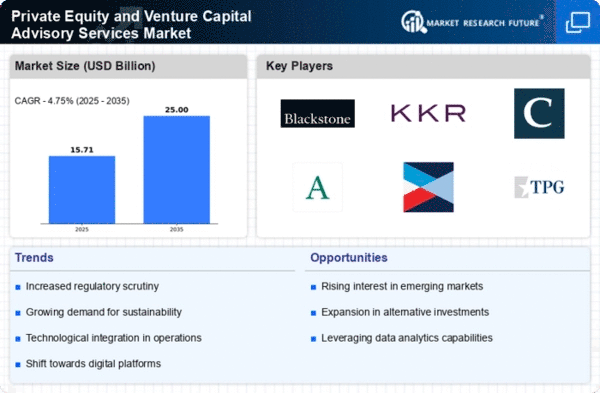

The Private Equity and Venture Capital Advisory Services Market is characterized by a dynamic competitive landscape, driven by factors such as increasing capital inflows, a growing number of startups, and the rising demand for innovative financing solutions. Major players like Blackstone Group (US), KKR & Co. (US), and Carlyle Group (US) are strategically positioned to leverage these trends. Blackstone Group (US) focuses on diversifying its investment portfolio, emphasizing technology and healthcare sectors, while KKR & Co. (US) has been enhancing its operational capabilities through digital transformation initiatives. Carlyle Group (US) appears to be concentrating on expanding its global footprint, particularly in emerging markets, thereby shaping a competitive environment that is increasingly collaborative yet fiercely competitive.The market structure is moderately fragmented, with a mix of large firms and smaller boutique advisory services. Key players employ various business tactics, such as localizing their services to cater to regional demands and optimizing their supply chains to enhance efficiency. This collective influence of major firms fosters a competitive atmosphere where innovation and strategic partnerships are paramount.

In November Blackstone Group (US) announced a strategic partnership with a leading fintech firm to enhance its data analytics capabilities. This move is likely to bolster Blackstone's ability to make informed investment decisions, thereby improving its competitive edge in the advisory services market. The integration of advanced analytics into their operations may also streamline their investment processes, allowing for quicker responses to market changes.

In October KKR & Co. (US) launched a new fund focused on sustainable investments, reflecting a growing trend towards environmental, social, and governance (ESG) criteria in investment decisions. This initiative not only aligns with global sustainability goals but also positions KKR as a leader in responsible investing, potentially attracting a new demographic of investors who prioritize ethical considerations alongside financial returns.

In September Carlyle Group (US) completed the acquisition of a regional advisory firm, which is expected to enhance its service offerings in the Asia-Pacific region. This acquisition signifies Carlyle's commitment to expanding its market presence and tapping into the burgeoning opportunities within this high-growth area. By integrating local expertise, Carlyle may improve its competitive positioning and better serve its clients in diverse markets.

As of December the competitive trends in the Private Equity and Venture Capital Advisory Services Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence (AI). Strategic alliances are becoming more prevalent, as firms recognize the value of collaboration in navigating complex market dynamics. Looking ahead, competitive differentiation is likely to evolve, shifting from traditional price-based competition to a focus on innovation, technology integration, and supply chain reliability. This transition may redefine how firms position themselves in the market, emphasizing the importance of adaptability and forward-thinking strategies.