Market Share

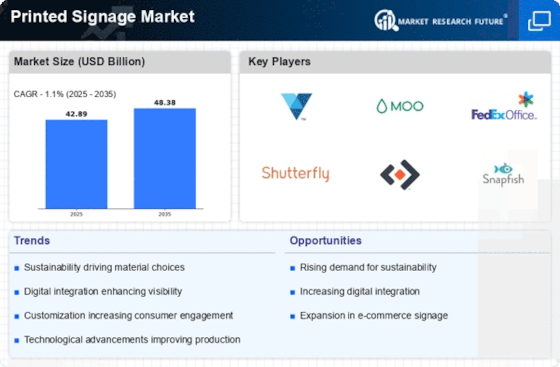

Printed Signage Market Share Analysis

In the bustling arena of the Printed Signage Market, strategies for market share positioning play a pivotal role in determining success and sustainability. With a myriad of players vying for attention, companies often employ diverse approaches to carve out their niche. One prevalent strategy revolves around product differentiation. By offering unique features or catering to specific customer needs, companies can distinguish themselves from competitors, attracting a dedicated clientele. For instance, some may focus on eco-friendly materials or innovative designs, appealing to environmentally conscious or design-savvy consumers respectively. This differentiation not only aids in capturing market share but also fosters brand loyalty, as customers associate distinct value propositions with particular brands.

The main factors assisting the printed signage market to endure in the face of fierce competition from the rising digital signage are the low deployment costs and longer lifespan of these types of signs.

Another avenue frequently explored is pricing strategy. In a landscape where price sensitivity is common, setting competitive prices can be a game-changer. Companies may opt for penetration pricing, initially offering products at lower prices to swiftly gain market share. Conversely, premium pricing can be employed for high-quality or exclusive offerings, targeting niche segments willing to pay a premium for superior value. Furthermore, dynamic pricing strategies, adjusting prices based on demand and market conditions, enable companies to optimize revenue while staying competitive. By strategically aligning pricing with target market preferences and competitive dynamics, companies can effectively position themselves for market share growth.

Moreover, distribution channels play a crucial role in market share positioning within the Printed Signage Market. A robust distribution network ensures widespread availability and accessibility of products, bolstering market penetration. Companies may leverage various channels such as direct sales, partnerships with retailers, or online platforms to reach diverse customer segments. Additionally, strategic alliances with distributors or collaborations with complementary businesses can enhance market reach and visibility. By optimizing distribution channels based on target market characteristics and preferences, companies can effectively expand their market share footprint.

Furthermore, marketing and branding strategies are indispensable tools for market share positioning. Effective branding not only differentiates a company from competitors but also influences consumer perceptions and preferences. Through strategic branding initiatives, companies can cultivate a distinct identity, resonating with their target audience and fostering brand loyalty. Marketing efforts encompass a spectrum of activities, from traditional advertising to digital marketing and social media engagement. By leveraging these channels to communicate compelling value propositions and engage with customers, companies can enhance brand visibility and drive market share growth.

Additionally, innovation and product development are key drivers of market share positioning in the Printed Signage Market. By continuously innovating and introducing new products or features, companies can stay ahead of the curve and capture market share. This could involve integrating advanced technologies such as digital printing or interactive signage solutions to offer novel experiences to customers. Furthermore, gathering feedback from customers and monitoring industry trends enable companies to anticipate evolving market needs and tailor their offerings accordingly. By investing in research and development, companies can sustainably position themselves for market share expansion and long-term success.

Leave a Comment