Market Analysis

In-depth Analysis of Printed Signage Market Industry Landscape

The market dynamics of the printed signage industry are influenced by various factors that shape its growth, trends, and competitiveness. Printed signage remains a significant component of marketing and communication strategies for businesses across diverse sectors, contributing to the market's continuous evolution. One key driver impacting this market is technological advancement. As printing technologies continue to improve, such as digital printing and UV printing, the quality, speed, and customization capabilities of printed signage have significantly enhanced. This advancement has led to a surge in demand for printed signage, especially from industries like retail, hospitality, and advertising.

Economies of scale, an increase in the usage of printed signage for marketing and advertising, and a globalization of brand identities, are the key market drivers enhancing the market growth.

Moreover, the growing emphasis on visual communication in marketing strategies has propelled the demand for eye-catching and impactful signage. Businesses recognize the importance of creating visually appealing displays to attract customers and convey brand messages effectively. Consequently, there's a constant need for innovative signage solutions, driving manufacturers to develop new materials, designs, and printing techniques to meet evolving customer demands.

The printed signage market is also influenced by economic factors and industry trends. Economic fluctuations, such as changes in consumer spending and business investments, can impact the demand for printed signage. During periods of economic growth, businesses tend to allocate more resources towards marketing and promotional activities, leading to increased demand for printed signage. Conversely, economic downturns may prompt businesses to reduce their marketing budgets, affecting the demand for signage.

Furthermore, environmental sustainability has become a significant consideration in the printed signage market. With increasing awareness about environmental issues, businesses are seeking eco-friendly signage solutions to align with their sustainability goals and meet consumer preferences. This has led to the development of eco-friendly materials, such as recyclable substrates and water-based inks, which offer environmentally responsible alternatives to traditional signage materials.

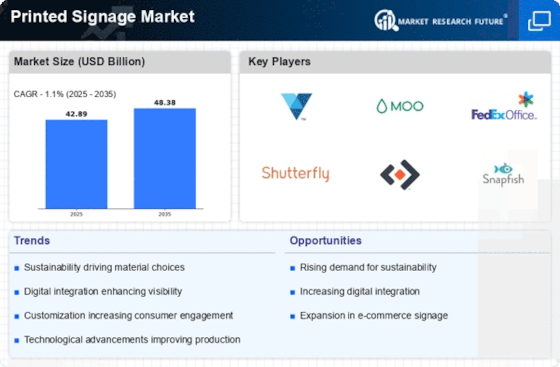

The competitive landscape of the printed signage market is characterized by the presence of numerous players, including large printing companies, small and medium-sized enterprises (SMEs), and online printing services. Competition is intense, with companies vying to differentiate themselves through factors such as price, quality, speed, and customer service. Additionally, technological innovation plays a crucial role in maintaining a competitive edge, as companies that invest in the latest printing technologies can offer superior products and services to their customers.

Moreover, globalization has widened the market reach for printed signage manufacturers, enabling them to cater to customers worldwide. Advances in logistics and distribution networks have facilitated efficient international trade, allowing companies to expand their operations and access new markets. This globalization trend has led to increased competition but also presents opportunities for growth and diversification.

Leave a Comment