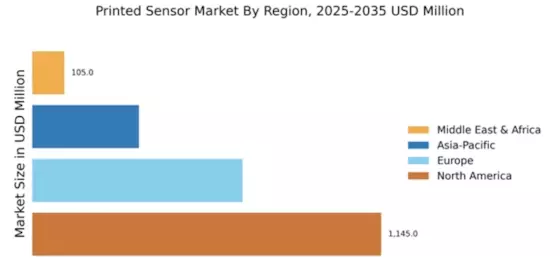

North America : Market Leader in Innovation

North America continues to lead the printed sensor market, holding a significant share of 1145.0M in 2024. The region's growth is driven by advancements in technology, increasing demand for smart packaging, and a robust regulatory framework that supports innovation. The presence of major players and a strong focus on R&D further catalyze market expansion, making it a hub for cutting-edge developments in printed sensors.

The United States stands out as the primary market, with key players like Cypress Semiconductor Corporation and Avery Dennison Corporation driving competition. The landscape is characterized by strategic partnerships and collaborations aimed at enhancing product offerings. As companies invest in sustainable technologies, North America is poised for continued growth, leveraging its technological prowess and market demand to maintain its leadership position.

Europe : Emerging Market with Potential

Europe's printed sensor market is valued at 690.0M, reflecting a growing interest in innovative applications across various sectors. The region benefits from stringent regulations promoting sustainability and safety, which drive demand for advanced sensor technologies. The increasing focus on IoT and smart devices further fuels market growth, as industries seek to integrate printed sensors into their operations for enhanced efficiency and data collection.

Leading countries such as Germany and the UK are at the forefront of this market, with companies like Nissha Co Ltd and PragmatIC Printing Ltd making significant contributions. The competitive landscape is marked by a mix of established firms and startups, fostering innovation and collaboration. As Europe continues to prioritize green technologies, the printed sensor market is expected to expand, supported by favorable policies and investment in research and development.

Asia-Pacific : Rapid Growth and Adoption

The Asia-Pacific region, with a market size of 350.0M, is rapidly emerging as a key player in the printed sensor market. The growth is driven by increasing industrial automation, rising consumer electronics demand, and government initiatives promoting smart technologies. Countries like Japan and China are leading the charge, with significant investments in R&D and manufacturing capabilities, positioning the region for substantial market expansion in the coming years.

Japan, home to companies like Nissha Co Ltd, is particularly influential, leveraging its technological advancements to enhance product offerings. The competitive landscape is dynamic, with both established firms and new entrants vying for market share. As the region embraces digital transformation, the demand for printed sensors is expected to surge, supported by favorable government policies and a growing emphasis on innovation.

Middle East and Africa : Emerging Market Opportunities

The Middle East and Africa (MEA) region, with a market size of 105.0M, presents emerging opportunities in the printed sensor market. The growth is primarily driven by increasing investments in smart city initiatives and a rising demand for advanced technologies in various sectors, including healthcare and automotive. Regulatory support for innovation and sustainability is also fostering a conducive environment for market expansion in this region.

Countries like South Africa and the UAE are leading the way, with a growing number of startups and established companies entering the market. The competitive landscape is evolving, characterized by collaborations and partnerships aimed at enhancing technological capabilities. As the MEA region continues to develop its infrastructure and technology landscape, the printed sensor market is expected to witness significant growth, driven by both local and international players.