Advancements in RFID Technology

The Printed & Chipless RFID Market is benefiting from continuous advancements in RFID technology. Innovations such as improved read ranges, enhanced data storage capabilities, and the development of chipless RFID tags are driving market growth. These advancements allow for more versatile applications across various sectors, including healthcare, logistics, and retail. For instance, the introduction of chipless RFID technology has the potential to reduce production costs while maintaining high performance. As these technologies evolve, they are likely to attract new players and investments in the Printed & Chipless RFID Market, further propelling its expansion.

Growing Adoption in Healthcare Sector

The Printed & Chipless RFID Market is experiencing increased adoption within the healthcare sector, where the need for accurate patient tracking and asset management is paramount. RFID technology is being utilized to monitor medical equipment, track pharmaceuticals, and enhance patient safety. Recent reports indicate that the healthcare sector's investment in RFID solutions is expected to grow by over 30% in the next five years. This growth is driven by the need to improve operational efficiency and reduce errors in patient care. As healthcare organizations recognize the benefits of RFID technology, the Printed & Chipless RFID Market is likely to see a significant uptick in demand.

Rising Demand for Inventory Management

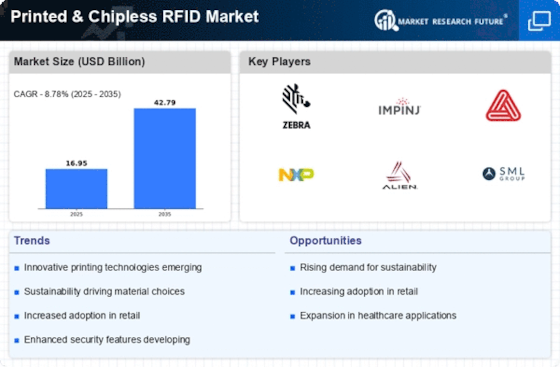

The Printed & Chipless RFID Market is experiencing a surge in demand for efficient inventory management solutions. Retailers and manufacturers are increasingly adopting RFID technology to enhance visibility and accuracy in their supply chains. According to recent data, the adoption of RFID in inventory management has led to a reduction in stock discrepancies by up to 30%. This trend is driven by the need for real-time tracking and the ability to streamline operations, which ultimately improves customer satisfaction. As businesses seek to optimize their inventory processes, the Printed & Chipless RFID Market is poised for substantial growth, with projections indicating a compound annual growth rate of over 20% in the coming years.

Cost-Effectiveness of Printed RFID Solutions

The Printed & Chipless RFID Market is witnessing a shift towards cost-effective solutions, particularly in the realm of printed RFID tags. These tags, which are less expensive to produce than traditional RFID tags, are becoming increasingly popular among small to medium-sized enterprises. The ability to print RFID tags on-demand reduces inventory costs and allows for greater flexibility in product labeling. Market analysis suggests that the cost of printed RFID tags has decreased by approximately 15% over the past few years, making them an attractive option for businesses looking to implement RFID technology without incurring significant expenses. This trend is likely to drive further adoption within the Printed & Chipless RFID Market.

Increased Focus on Supply Chain Transparency

The Printed & Chipless RFID Market is significantly influenced by the growing emphasis on supply chain transparency. Consumers and regulatory bodies are demanding greater visibility into product origins and supply chain processes. RFID technology facilitates this transparency by enabling real-time tracking of products from manufacturing to retail. Recent studies indicate that companies utilizing RFID solutions have reported a 25% improvement in supply chain efficiency. As businesses strive to meet consumer expectations and comply with regulations, the Printed & Chipless RFID Market is expected to expand, with more organizations investing in RFID systems to enhance their operational transparency.