Market Analysis

In-depth Analysis of Predictive Genetic Testing and Consumer Wellness Genomics Market Industry Landscape

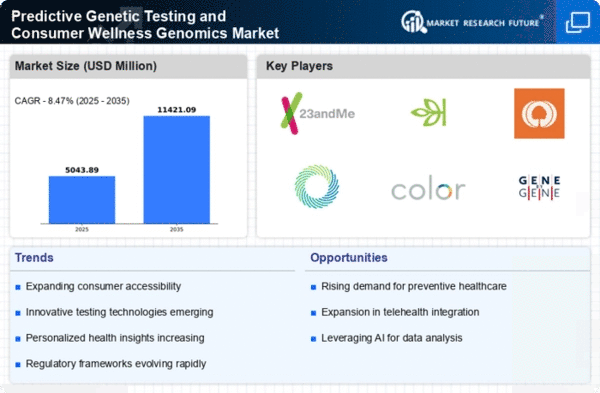

Due to genomic technologies, public awareness, and a desire for individualized treatment, predictive genetic testing and consumer wellness genomics are increasing rapidly. These marketplaces provide genetic testing that reveal a person's lifestyle, illness propensity, and general health. Rising consumer knowledge and participation in genetics drives market dynamics. A consumer-driven industry for predictive genetic testing and wellness genomics has grown as people seek proactive health solutions. Direct-to-consumer genetic testing is growing. DTC services enable consumers to get genetic information without healthcare practitioner participation, increasing accessibility, convenience, and market growth. Disease risk is the main focus of predictive genetic testing. The growth of genetic test disease indicators, from common ailments like cardiovascular disease to uncommon genetic abnormalities, provides consumers with complete health information and shapes market dynamics. Market dynamics depend on genome sequencing advances. Due to lower sequencing costs, increased accuracy, and efficiency, genetic testing is now more accessible to a broader audience, driving market expansion. The predictive genetic testing and wellness genomics industry is affected by AI and data analytics. These technologies improve genetic data interpretation, enabling more nuanced and individualized disease risk, nutritional, and lifestyle insights and commercial innovation. Regulations and genetic privacy concerns affect market dynamics. To earn customer confidence and comply with changing regulatory norms, market actors are installing stronger privacy protections to assure ethical genetic data usage. Lifestyle optimization is part of consumer wellness genomics beyond illness risk assessment. Genetic testing that provides insights into diet, exercise, sleep habits, and other lifestyle aspects is becoming more popular, allowing people to make healthy decisions. Healthcare provider-genetic testing company partnerships are influencing the industry. These collaborations incorporate genetic information into the healthcare ecosystem to provide tailored and preventative treatment and increase clinical genetic testing. Predictive genetic testing and consumer wellness genomics markets are global. As awareness and technology improve, the worldwide market expands. Market dynamics are diversifying as emerging economies shine. Educational attempts to improve genetic literacy affect the market. Genetic counseling services are increasingly essential to the market, providing full genetic test findings and enabling informed decision-making. Looking forward, the predictive genetic testing and consumer wellness genomics business is positioned for continuous innovation. Genetic data integration with digital health platforms, testing panel extension, and genomic interpretation of non-coding areas may be future developments. As these markets evolve, technology advances, legislative changes, and genomics' inclusion into mainstream healthcare and lifestyle practices will affect the dynamics.

Leave a Comment