Increased Investment in Genomic Research

The France predictive genetic testing consumer wellness genomics market benefits from increased investment in genomic research. Government initiatives and private sector funding are fostering advancements in genetic research, which in turn enhances the development of consumer-oriented genetic testing services. For instance, the French government has allocated significant resources to genomic research projects, aiming to position France as a leader in the field. This influx of funding is likely to accelerate innovation and improve the availability of genetic testing options for consumers, thereby expanding the market. The emphasis on research and development is crucial for sustaining growth in the consumer wellness genomics sector.

Rising Health Consciousness Among Consumers

The France predictive genetic testing consumer wellness genomics market is significantly influenced by the rising health consciousness among consumers. As individuals become more aware of the impact of genetics on health, there is a growing inclination to utilize genetic testing as a proactive measure for health management. This trend is reflected in the increasing number of consumers seeking genetic tests to understand their health risks and make informed lifestyle choices. The market is expected to grow as health-conscious consumers prioritize preventive measures, indicating a shift towards a more proactive approach to wellness. This cultural shift is likely to drive demand for genetic testing services.

Technological Advancements in Genetic Testing

The France predictive genetic testing consumer wellness genomics market is experiencing a surge in technological advancements that enhance the accuracy and efficiency of genetic testing. Innovations such as next-generation sequencing (NGS) and CRISPR technology are becoming increasingly accessible to consumers. These advancements not only improve the reliability of test results but also reduce the time required for analysis. As a result, consumers are more inclined to utilize genetic testing services, leading to a projected market growth rate of approximately 10% annually. This growth is indicative of a broader trend where technology plays a pivotal role in shaping consumer choices in the wellness sector.

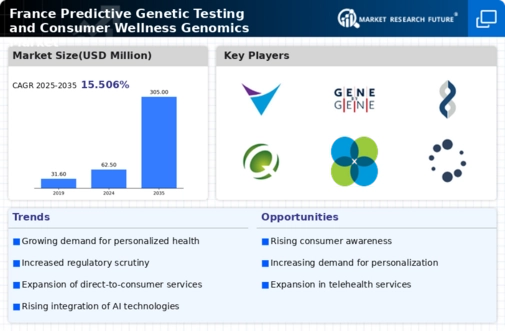

Expansion of Direct-to-Consumer Genetic Testing

The France predictive genetic testing consumer wellness genomics market is experiencing an expansion of direct-to-consumer (DTC) genetic testing services. This model allows consumers to access genetic tests without the need for a healthcare provider, making testing more accessible and appealing. The convenience of DTC testing is attracting a broader audience, particularly among younger demographics who are more inclined to engage with technology. As a result, the market is projected to see a compound annual growth rate of 12% over the next five years. This expansion reflects a significant shift in how consumers approach genetic testing, emphasizing the importance of accessibility and consumer empowerment in the wellness genomics landscape.

Growing Demand for Personalized Health Solutions

The France predictive genetic testing consumer wellness genomics market is witnessing a notable shift towards personalized health solutions. Consumers are increasingly seeking tailored health recommendations based on their genetic profiles. This trend is driven by a growing understanding of the relationship between genetics and health, prompting individuals to invest in genetic testing to gain insights into their predispositions to various health conditions. The market is projected to reach a valuation of 500 million euros by 2027, reflecting the rising consumer demand for personalized wellness strategies. This shift underscores the importance of genetic testing in informing lifestyle choices and preventive health measures.