Growing Interest in Preventive Healthcare

The growing interest in preventive healthcare is a significant driver for the Italy predictive genetic testing consumer wellness genomics market. As consumers become more proactive about their health, they are increasingly turning to genetic testing as a tool for early disease detection and prevention. This shift is reflected in the rising number of individuals seeking genetic tests to identify potential health risks. Recent data indicates that nearly 40% of Italians are now considering genetic testing as part of their preventive health strategies. This trend not only highlights the importance of genetic insights in personal health management but also suggests a potential expansion of the market as more individuals recognize the value of preventive measures.

Technological Advancements in Genetic Testing

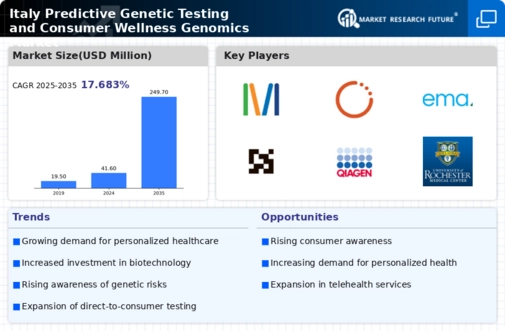

Technological advancements are significantly influencing the Italy predictive genetic testing consumer wellness genomics market. Innovations in sequencing technologies, such as next-generation sequencing (NGS), have made genetic testing more accessible and affordable. These advancements allow for more accurate and comprehensive genetic analyses, which are crucial for consumers seeking detailed health information. The market has seen a growth rate of approximately 15% annually, driven by these technological improvements. Additionally, the development of user-friendly testing kits and mobile applications enhances consumer engagement, making genetic testing a more attractive option for health-conscious individuals in Italy. This trend indicates a robust future for the industry as technology continues to evolve.

Supportive Government Policies and Initiatives

Supportive government policies and initiatives are playing a crucial role in shaping the Italy predictive genetic testing consumer wellness genomics market. The Italian government has been actively promoting genetic research and testing as part of its public health strategy. Initiatives aimed at increasing access to genetic testing services are being implemented, which may enhance consumer confidence in these services. Furthermore, regulatory frameworks are evolving to ensure the safety and efficacy of genetic tests, thereby fostering a more robust market environment. This supportive landscape is likely to encourage more companies to enter the market, contributing to its growth and development in the coming years.

Rising Demand for Personalized Health Solutions

The Italy predictive genetic testing consumer wellness genomics market is experiencing a notable increase in demand for personalized health solutions. Consumers are increasingly seeking tailored health insights that align with their genetic profiles. This trend is driven by a growing awareness of the importance of genetics in health management. According to recent surveys, approximately 60% of Italians express interest in genetic testing to understand their health risks better. This rising demand is prompting companies to innovate and offer more comprehensive testing services, thereby expanding the market. Furthermore, the integration of genetic testing into routine health assessments is becoming more common, suggesting a shift towards personalized healthcare in Italy.

Increased Collaboration Between Healthcare Providers and Genetic Testing Companies

Increased collaboration between healthcare providers and genetic testing companies is emerging as a key driver in the Italy predictive genetic testing consumer wellness genomics market. Such partnerships facilitate the integration of genetic testing into standard healthcare practices, enhancing the overall consumer experience. Healthcare professionals are increasingly recognizing the value of genetic insights in informing treatment decisions and preventive strategies. This collaboration is expected to lead to a more streamlined process for consumers seeking genetic testing services. As a result, the market is likely to witness a surge in demand as healthcare providers advocate for genetic testing as a vital component of personalized healthcare.