Regulatory Support for Refurbished Devices

The Pre-Owned Medical Device Market benefits from increasing regulatory support for refurbished medical devices. Regulatory bodies are recognizing the importance of ensuring that pre-owned devices meet safety and efficacy standards. This has led to the establishment of guidelines that facilitate the refurbishment process, thereby enhancing consumer confidence in these products. For instance, recent initiatives have streamlined the approval process for refurbished devices, making it easier for manufacturers to enter the market. As a result, the pre-owned medical device market is likely to expand, as healthcare providers become more willing to adopt refurbished equipment that complies with stringent regulations. This regulatory environment not only promotes safety but also encourages innovation within the industry.

Growing Focus on Sustainability in Healthcare

The Pre-Owned Medical Device Market is increasingly aligned with the growing focus on sustainability within the healthcare sector. As environmental concerns gain prominence, healthcare providers are seeking ways to reduce waste and minimize their carbon footprint. The reuse of medical devices not only conserves resources but also reduces the environmental impact associated with manufacturing new equipment. Recent studies suggest that adopting pre-owned devices can lead to a significant reduction in medical waste, thereby appealing to environmentally conscious institutions. This trend is likely to drive the growth of the pre-owned medical device market, as healthcare organizations strive to implement sustainable practices while maintaining operational efficiency.

Technological Innovations in Device Refurbishment

Technological advancements are playing a pivotal role in the Pre-Owned Medical Device Market. Innovations in refurbishment techniques and quality assurance processes are enhancing the reliability and performance of pre-owned devices. For example, the integration of advanced diagnostic tools and automated refurbishment systems has improved the efficiency of the refurbishment process. This has led to a higher quality of refurbished devices, making them more appealing to healthcare providers. Market data indicates that the adoption of these technologies could potentially increase the market share of pre-owned devices by up to 15% in the coming years. As healthcare facilities seek to balance cost and quality, the role of technology in the refurbishment process becomes increasingly critical.

Increasing Demand for Affordable Healthcare Solutions

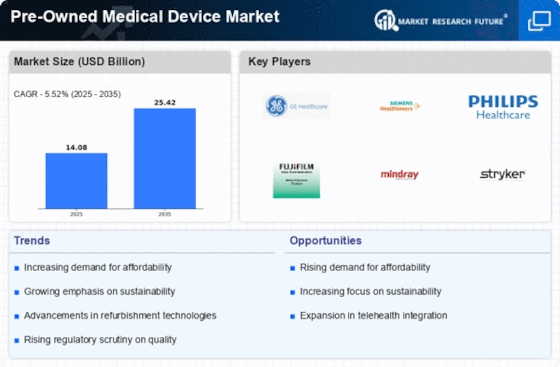

The Pre-Owned Medical Device Market is experiencing a surge in demand for affordable healthcare solutions. As healthcare costs continue to rise, hospitals and clinics are increasingly seeking cost-effective alternatives to new medical devices. This trend is particularly pronounced in developing regions, where budget constraints limit access to advanced medical technology. According to recent data, the pre-owned medical device market is projected to grow at a compound annual growth rate of approximately 12% over the next five years. This growth is driven by the need for healthcare facilities to optimize their budgets while maintaining high standards of patient care. Consequently, the pre-owned medical device market is becoming an essential component of healthcare procurement strategies, allowing institutions to allocate resources more efficiently.

Rising Acceptance of Pre-Owned Devices Among Healthcare Providers

The Pre-Owned Medical Device Market is witnessing a notable shift in the acceptance of pre-owned devices among healthcare providers. As the quality and reliability of refurbished devices improve, more hospitals and clinics are willing to incorporate them into their operations. This acceptance is further fueled by the increasing availability of warranties and service agreements that accompany refurbished devices, providing additional assurance to healthcare providers. Market analysis indicates that the acceptance rate of pre-owned devices has increased by approximately 20% over the past few years. This trend suggests a growing recognition of the value that pre-owned devices can offer, particularly in resource-constrained environments, thereby bolstering the overall market.