Growth of Electric Power Sports Vehicles

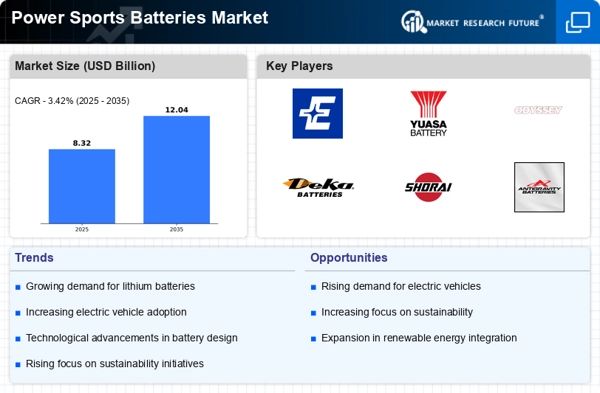

The transition towards electric power sports vehicles is a pivotal driver for the Power Sports Batteries Market. As environmental concerns rise, consumers are increasingly opting for electric alternatives to traditional gasoline-powered vehicles. This shift is supported by advancements in battery technology, which have made electric power sports vehicles more viable. The market for electric ATVs and motorcycles is projected to grow at a compound annual growth rate of 8% over the next five years. This growth is likely to stimulate demand for high-capacity batteries that can support longer ranges and faster charging times, thereby enhancing the overall user experience. Manufacturers are responding to this trend by developing specialized batteries tailored for electric power sports applications.

Technological Innovations in Battery Design

Technological advancements play a crucial role in shaping the Power Sports Batteries Market. Innovations in battery design, such as the development of lithium-ion and lithium-polymer batteries, have significantly improved energy density and charging times. These advancements not only enhance the performance of power sports vehicles but also extend their operational lifespan. The market has witnessed a shift towards lighter and more efficient battery solutions, which are essential for high-performance applications. As manufacturers invest in research and development, the introduction of smart batteries with integrated monitoring systems is becoming more prevalent. This trend indicates a potential for increased safety and efficiency in power sports applications, further driving market growth.

Increasing Demand for Recreational Activities

The Power Sports Batteries Market experiences a notable surge in demand due to the rising popularity of recreational activities such as off-roading, snowmobiling, and personal watercraft usage. As more individuals seek outdoor adventures, the need for reliable power sports batteries becomes paramount. In recent years, the market has seen a growth rate of approximately 5% annually, driven by the increasing participation in these activities. This trend is likely to continue as manufacturers innovate to enhance battery performance and longevity, catering to the needs of enthusiasts. Furthermore, the expansion of rental services for power sports vehicles contributes to the demand for high-quality batteries, as these services require dependable power sources to ensure customer satisfaction.

Regulatory Support for Clean Energy Solutions

Regulatory frameworks promoting clean energy solutions significantly influence the Power Sports Batteries Market. Governments worldwide are implementing policies aimed at reducing carbon emissions and encouraging the adoption of electric vehicles, including power sports options. Incentives such as tax rebates and subsidies for electric vehicle purchases are becoming more common, which may lead to increased sales of electric power sports vehicles and, consequently, a higher demand for advanced battery technologies. The alignment of industry standards with environmental goals suggests a favorable market environment for battery manufacturers. As regulations evolve, companies that adapt to these changes are likely to gain a competitive edge in the power sports batteries sector.

Rising Consumer Awareness of Battery Performance

Consumer awareness regarding battery performance and longevity is increasingly shaping the Power Sports Batteries Market. As users become more informed about the importance of battery quality, they are more likely to invest in high-performance batteries that offer better reliability and efficiency. This trend is evident in the growing preference for brands that provide detailed specifications and performance metrics. Market Research Future indicates that consumers are willing to pay a premium for batteries that promise enhanced durability and faster charging capabilities. This shift in consumer behavior is likely to drive manufacturers to focus on quality and innovation, ensuring that their products meet the evolving expectations of power sports enthusiasts.