North America : Market Leader in Services

North America is poised to maintain its leadership in the Power Grid Equipment Maintenance and Repair Services Market, holding a significant market share of 12.5 in 2024. The region's growth is driven by increasing investments in infrastructure, the push for renewable energy integration, and stringent regulatory frameworks aimed at enhancing grid reliability. The demand for advanced maintenance solutions is further fueled by aging infrastructure and the need for modernization.

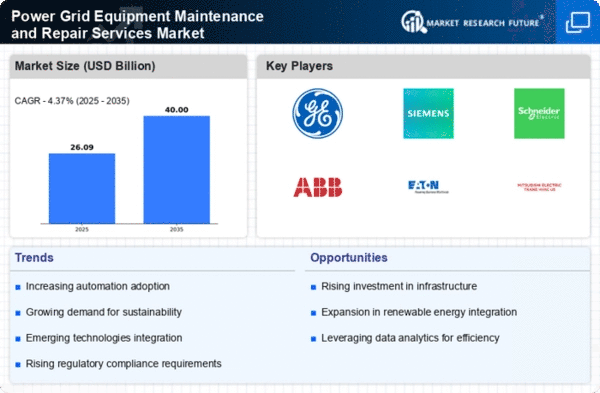

The competitive landscape in North America is robust, featuring key players such as General Electric, Siemens, and Eaton. These companies are leveraging technological advancements to offer innovative solutions that meet the evolving needs of the market. The presence of a well-established regulatory environment supports the growth of maintenance services, ensuring compliance and safety standards are met. This dynamic environment positions North America as a critical hub for power grid services.

Europe : Emerging Market Dynamics

Europe is experiencing a notable shift in the Power Grid Equipment Maintenance and Repair Services Market, with a market size of 7.5 in 2024. The region's growth is driven by the European Union's commitment to sustainability and the Green Deal, which emphasizes the modernization of energy infrastructure. Regulatory incentives for renewable energy sources and energy efficiency are also key catalysts for demand in maintenance services, as countries strive to meet ambitious climate targets.

Leading countries such as Germany, France, and the UK are at the forefront of this transformation, with major players like Siemens and Schneider Electric actively participating in the market. The competitive landscape is characterized by a focus on innovation and collaboration, as companies seek to enhance service offerings and improve operational efficiency. This strategic approach is essential for navigating the evolving regulatory landscape and meeting the increasing demand for reliable power services.

Asia-Pacific : Rapid Growth and Investment

The Asia-Pacific region is witnessing rapid growth in the Power Grid Equipment Maintenance and Repair Services Market, with a market size of 4.5 in 2024. This growth is driven by increasing urbanization, industrialization, and government initiatives aimed at enhancing energy security. Countries in this region are investing heavily in modernizing their power grids to accommodate rising energy demands and integrate renewable energy sources, creating a favorable environment for maintenance services.

Key players such as Mitsubishi Electric and Hitachi Energy are expanding their presence in the region, capitalizing on the growing demand for advanced maintenance solutions. Countries like China and India are leading the charge, supported by government policies that promote infrastructure development. The competitive landscape is evolving, with a focus on technological innovation and strategic partnerships to enhance service delivery and operational efficiency, positioning Asia-Pacific as a vital market for power services.

Middle East and Africa : Emerging Market Potential

The Middle East and Africa (MEA) region is at the nascent stage of development in the Power Grid Equipment Maintenance and Repair Services Market, with a market size of 0.5 in 2024. The region's growth is primarily driven by increasing investments in energy infrastructure and the need for reliable power supply. Governments are recognizing the importance of modernizing their power grids to support economic growth and meet the rising energy demands, creating opportunities for maintenance services.

Countries like South Africa and the UAE are leading the way in infrastructure development, with key players beginning to establish a foothold in the market. The competitive landscape is characterized by a mix of local and international companies seeking to capitalize on emerging opportunities. As regulatory frameworks evolve, the potential for growth in the MEA region is significant, making it an attractive market for power grid services.