North America : Market Leader in Smart Grid Services

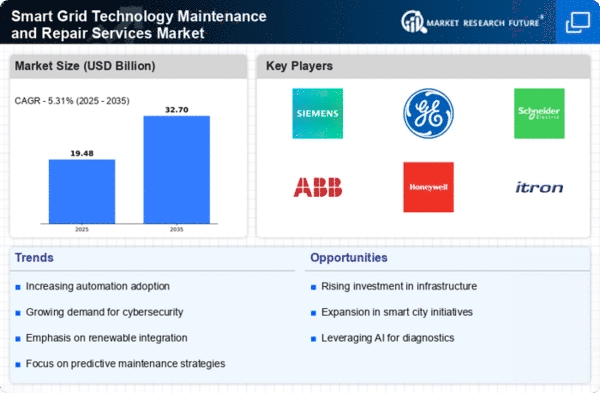

North America is poised to maintain its leadership in the Smart Grid Technology Maintenance and Repair Services Market, holding a significant market share of 9.25 in 2024. The region's growth is driven by increasing investments in renewable energy, regulatory support for smart grid initiatives, and a rising demand for energy efficiency. Government incentives and policies aimed at modernizing the electrical grid further catalyze this growth, making it a hotbed for innovation and technological advancements. The competitive landscape in North America is robust, featuring key players such as Siemens, General Electric, and Honeywell. The U.S. stands out as the leading country, with substantial investments in smart grid technologies. The presence of major corporations and a strong focus on R&D contribute to a dynamic market environment. As utilities seek to enhance grid reliability and integrate renewable sources, the demand for maintenance and repair services is expected to surge, solidifying North America's position as a market leader.

Europe : Emerging Market with Strong Potential

Europe is rapidly evolving in the Smart Grid Technology Maintenance and Repair Services Market, with a market size of 5.5. The region's growth is fueled by stringent regulations aimed at reducing carbon emissions and enhancing energy efficiency. The European Union's commitment to sustainability and the Green Deal initiatives are significant drivers, encouraging investments in smart grid technologies and infrastructure upgrades. This regulatory environment fosters innovation and attracts funding for maintenance and repair services. Leading countries in Europe include Germany, France, and the UK, where major players like Schneider Electric and ABB are actively involved. The competitive landscape is characterized by a mix of established firms and emerging startups, all vying for market share. As utilities modernize their grids to accommodate renewable energy sources, the demand for maintenance services is expected to rise, positioning Europe as a key player in the global market.

Asia-Pacific : Rapid Growth in Emerging Markets

The Asia-Pacific region is witnessing significant growth in the Smart Grid Technology Maintenance and Repair Services Market, with a market size of 3.0. This growth is driven by increasing urbanization, rising energy demands, and government initiatives to modernize electrical infrastructure. Countries like China and India are leading the charge, implementing smart grid projects to enhance energy efficiency and reliability. Regulatory support and investments in renewable energy further bolster market expansion in this region. China is the dominant player in the Asia-Pacific market, with substantial investments in smart grid technologies. The competitive landscape features both local and international players, including Itron and Landis+Gyr. As the region continues to invest in smart grid solutions, the demand for maintenance and repair services is expected to grow, making Asia-Pacific a vital area for market development and innovation.

Middle East and Africa : Emerging Opportunities in Energy Sector

The Middle East and Africa region is gradually emerging in the Smart Grid Technology Maintenance and Repair Services Market, with a market size of 1.75. The growth is primarily driven by increasing energy demands and the need for efficient energy management systems. Governments in the region are recognizing the importance of smart grid technologies to enhance energy security and sustainability, leading to investments in infrastructure and maintenance services. Regulatory frameworks are evolving to support these initiatives, creating a conducive environment for market growth. Countries like South Africa and the UAE are at the forefront of this transformation, with key players such as Eaton and Cisco Systems actively participating in the market. The competitive landscape is characterized by a mix of local and international firms, all aiming to capitalize on the growing demand for smart grid solutions. As the region continues to develop its energy infrastructure, the need for maintenance and repair services will likely increase, presenting significant opportunities for growth.