North America : Innovation and Sustainability Focus

The North American power generation market is poised for significant growth, driven by a shift towards renewable energy sources and regulatory support for sustainability initiatives. With a market size of $300.0 billion, the region is witnessing increased investments in solar and wind energy, spurred by government incentives and public demand for cleaner energy solutions. The transition to a low-carbon economy is a key driver, with states implementing stricter emissions regulations to meet climate goals. Leading the charge are the United States and Canada, where major players like NextEra Energy and Duke Energy are investing heavily in renewable projects. The competitive landscape is evolving, with traditional utilities adapting to new technologies and market entrants focusing on innovative solutions. The presence of established companies alongside emerging startups is fostering a dynamic environment, ensuring that North America remains a leader in the global power generation sector.

Europe : Renewable Energy Leader

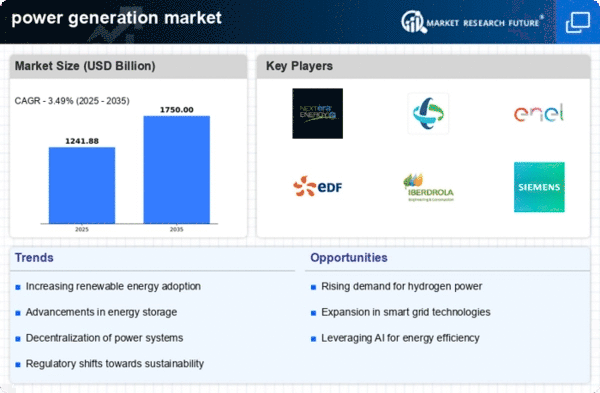

Europe's power generation market, valued at $250.0 billion, is characterized by a strong commitment to renewable energy and sustainability. The region is experiencing robust growth driven by ambitious climate targets and regulatory frameworks that promote clean energy adoption. The European Green Deal and national policies are catalyzing investments in wind, solar, and hydroelectric power, positioning Europe as a global leader in renewable energy generation. Countries like Germany, France, and Spain are at the forefront of this transformation, with key players such as Enel, EDF, and Iberdrola leading the charge. The competitive landscape is marked by a mix of traditional energy companies and innovative startups, all vying for a share of the growing market. The European Union's commitment to reducing greenhouse gas emissions by at least 55% by 2030 is a significant driver of this growth, ensuring a sustainable future for the region's power generation sector.

Asia-Pacific : Emerging Powerhouse in Energy

The Asia-Pacific region dominates The power generation market, with a staggering market size of $650.0 billion. This growth is fueled by rapid industrialization, urbanization, and increasing energy demand across countries like China and India. Government initiatives aimed at enhancing energy security and transitioning to renewable sources are pivotal in shaping the market landscape. The region's commitment to reducing carbon emissions is driving investments in clean energy technologies, making it a focal point for global energy transition efforts. China stands out as a leader in power generation, with companies like China Yangtze Power spearheading advancements in renewable energy. Japan and India are also significant players, with Tokyo Electric Power Company and various local firms investing heavily in sustainable projects. The competitive environment is characterized by a mix of state-owned enterprises and private companies, all striving to meet the growing energy needs of the region while adhering to environmental regulations.