Top Industry Leaders in the Postal Automation System Market

*Disclaimer: List of key companies in no particular order

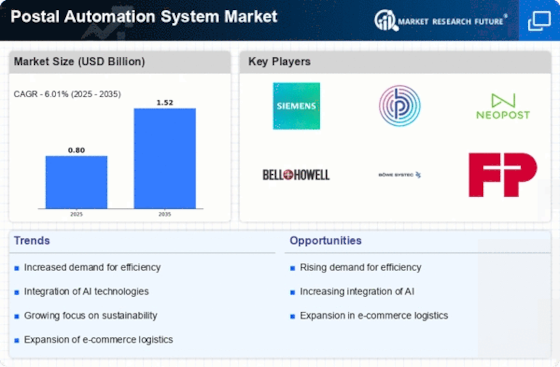

Competitive Landscape of Postal Automation System Market

The postal automation system market navigates a dynamic terrain defined by rising e-commerce demands, technological advancements, and intensifying competition. This landscape features established players alongside new entrants, all vying for market share and grappling with diverse market forces. To understand this complex ecosystem, we delve into the adopted strategies, key factors for market share analysis, the rise of new companies, and the overall competitive scenario.

Some of the Postal Automation System companies listed below:

- Toshiba Corporation

- Mitsubishi Logistics

- Escher Group

- NEC Corporation

- Accenture PLC

- Siemens AG

- Fujitsu

- Vanderlande

- Falcon Autotech

- Solystic SAS

Strategies Adopted by Key Players:

- Acquisition Spree: Strategic acquisitions are another prominent tactic. For instance, Toshiba's acquisition of Pitney Bowes's document management business strengthens its presence in the North American market. These mergers and acquisitions expand geographical reach, diversify product offerings, and consolidate market power.

- Cost Optimization and Efficiency: Rising operational costs compel players to prioritize cost-effectiveness. Automation solutions themselves contribute to this goal, but companies are also adopting lean manufacturing methods and optimizing supply chains to maximize profitability.

- Partnership Ecosystem: Collaboration is key. Established players partner with niche technology providers, startups, and research institutions to gain access to specialized expertise and accelerate innovation. This creates a dynamic ecosystem where knowledge and resources are shared, propelling the market forward.

Factors for Market Share Analysis:

- Product Portfolio Breadth: The ability to offer a comprehensive range of solutions for various sorting, processing, and delivery needs is crucial. Players with diverse offerings cater to a wider customer base, gaining an edge.

- Technological Innovation: Continuous investment in research and development is essential to stay ahead of the curve. Integrating cutting-edge technologies like AI, robotics, and machine vision into postal automation systems enhances efficiency and attracts tech-savvy customers.

- Customization and Integration: Offering customized solutions and seamless integration with existing postal infrastructure is key to winning over clients. Players who provide flexible and adaptable systems gain a competitive advantage.

- Customer Service and Support: Reliable after-sales support and maintenance services are essential for building trust and long-term relationships with customers. Established players with robust service networks often have an upper hand.

New and Emerging Companies:

The market is witnessing the emergence of several startups and smaller players offering innovative solutions and niche capabilities. These companies are:

- Focusing on Specific Segments: Some startups cater to specific segments like parcel sorting or delivery automation, offering specialized solutions that address unique challenges.

- Leveraging Cloud-Based Technologies: Cloud-based software platforms for postal automation are gaining traction, offering scalability and cost-effectiveness. Emerging players are capitalizing on this trend.

- Embracing Emerging Technologies: Startups are readily adopting cutting-edge technologies like drone delivery and automated delivery vehicles, providing innovative solutions for the future of postal services.

Latest Company Updates:

On Apr. 11, 2023, Kuryenet, a renowned parcel distribution and postal services company in Turkey, announced the completion of the installation of a new automated robotic parcel sorting system at the Tuzla depot in Istanbul. According to the company, it is the biggest application of robot-based sorting technology in Europe and the first of its kind installation in Turkey.

This system was designed and fitted by LiBiao Robotics, partnering with Lodamaster, a Turkish distribution and aftersales support firm. The sortation system can process some 45,000 items per hour and uses 120 LiBiao Mini Yellow autonomous mobile robots (AMRs) to connect over 700 destination channels with five parcel induction points.

On Aug.04, 2022, FedEx announced signing a warrant agreement with Berkshire Grey, an AI-enabled supply chain robotics providing company. Expanding the robotic automation relationship includes plans for automation development and accelerating the implementation of Berkshire Grey's solutions in FedEx operating companies. These companies will undertake new development activities on AI robotic automation capabilities, improving the safety and efficiency of FedEx package handling operations.

On Feb.11, 2022, Körber, a German technology and supply chain specialist, announced the acquisition of Siemens Logistics' global mail and parcel business. Siemens Logistics develops and supplies mail & parcel automation technologies and advanced software to leading global logistics providers. The acquisition significantly complements Körber's supply chain offering, enabling it to broaden its market offering as a globally leading partner in the supply chain and e-commerce industry.

On Jan. 23, 2023, DHL Supply Chain announced the opening of a robotic fulfillment center in Germany, implementing a fully automated robot picking system, AutoStore. The implantation of the logistics center is for fashion retailer Peek & Cloppenburg Düsseldorf in the Lower Saxon municipality of Staufenberg. AutoStore is an automated storage and order fulfillment system by robot company Element Logic.