Research Methodology on Home Automation System Market

Introduction

Home automation systems are electronic, computer-controlled systems that enable users to control and monitor devices in their homes from a remote location. They also allow remote monitoring and control of lighting, heating, cooling, security, and entertainment systems. Home automation systems provide users with many benefits, such as increased energy efficiency, greater convenience and security, enhanced comfort, and enhanced home entertainment.

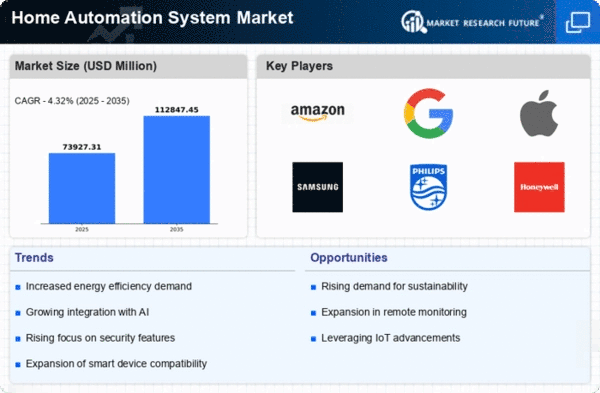

Market Research Future’s report on the Global Home Automation System Market provides a thorough analysis of the market’s development over the forecast period (2023-2030). It assesses the market dynamics, trends, leading players, and the level of competition in the market.

Objective of the Study

The objective of this study is to provide a detailed market analysis to help current and prospective investors gain a comprehensive understanding of the Home Automation System market.

Research Methodology

The research presented in this report is based on both primary and secondary data. Primary sources include interviews with manufacturers, suppliers, distributors, and other industry stakeholders. Secondary sources include publicly available data on white papers, annual reports, trade publications, and other publications for the Home Automation System market. The report includes both quantitative and qualitative information such as market size, technology trends, market dynamics, and competitive landscape.

Scope of the Study

The research offers an in-depth analysis of the Home Automation System market with forecasts from 2023 to 2030. This report covers industry trends and insights, strategic recommendations, company overviews, and the impact of Porter’s Five Forces on the market’s key players. It also provides market insights regarding various market segmentations, including product type, industry, technology, region, and end-user.

Market Segmentation

The report is segmented on the basis of product type, industry, technology, region, and end user.

By Product Type

Lighting Control System

HVAC Control System

Security and Access Control System

Entertainment Control System

By Industry

Residential

Commercial

Industrial

By Technology

Wired

Wireless

By Region

North America

Europe

Asia Pacific

Middle East & Africa

Latin America

By End User

Residential

Commercial

Industrial

Data Collection & Analysis

Market data collected for this report is obtained through secondary and primary sources. Secondary sources include industry magazines, statistical research, business journals, financial news services, proprietary databases, and company websites. Primary sources include interviews with key industry stakeholders, including manufacturers, distributors, and retailers.

The analysis is conducted using various market models, such as market segmentation, Porter’s Five Forces analysis, SWOT analysis, and market attractiveness analysis. Market models are used to develop insights into key trends and the competitive landscape. Additionally, market models are used to identify opportunities and threats in the market.

Data analysis techniques include descriptive and inferential statistics, such as correlation analysis, regression analysis, time-series analysis, and principal component analysis. Qualitative data also is used to compare data points, draw conclusions, and understand the dynamics and trends in the Home Automation System market.

Research Findings & Conclusions

The Home Automation System market is projected to expand at a rapid pace over the forecast period, driven by factors such as the increasing demand for energy-efficient solutions and the introduction of technologies such as artificial intelligence, voice assistants, and machine learning. The report segments the Home Automation System market by product type, industry, technology, region, and end user.

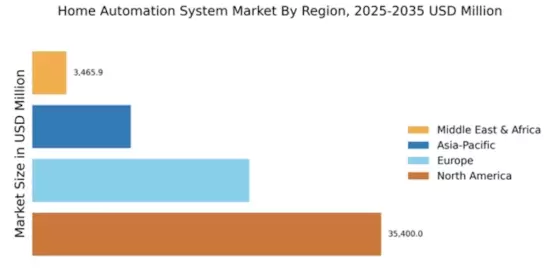

The Asia-Pacific region is expected to be the fastest-growing market, due to the increasing demand for connected home solutions. The report also provides insights into competitive landscape and strategic recommendation for players operating in the market.

The insights gathered from the research can be used to gain a comprehensive understanding of the Home Automation System market, enabling informed decision-making and strategizing. Moreover, insights into market dynamics can be leveraged to better understand the competitive landscape, enabling players to make informed decisions.