Regulatory Support

Regulatory support is emerging as a significant driver for the Polyethylene Furanoate Film Market. Governments worldwide are implementing stringent regulations aimed at reducing plastic waste and promoting the use of biodegradable materials. Policies that incentivize the adoption of sustainable packaging solutions are likely to bolster the market for polyethylene furanoate films. For example, certain regions have introduced tax breaks for companies utilizing eco-friendly materials, which could enhance market penetration. This regulatory landscape not only encourages innovation but also creates a favorable environment for the Polyethylene Furanoate Film Market to thrive, as businesses align their strategies with governmental sustainability objectives.

Sustainability Initiatives

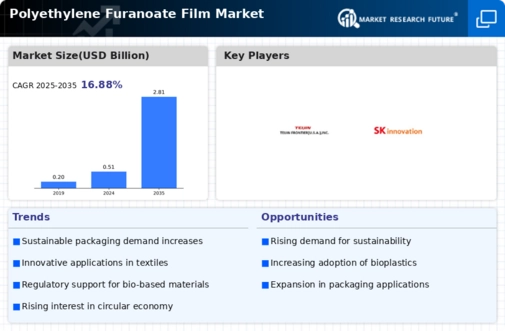

The increasing emphasis on sustainability is a pivotal driver for the Polyethylene Furanoate Film Market. As consumers and businesses alike become more environmentally conscious, the demand for biodegradable and renewable materials is surging. Polyethylene furanoate, derived from renewable resources, aligns with these sustainability goals, offering a viable alternative to traditional petroleum-based plastics. This shift is reflected in market data, indicating a projected growth rate of approximately 15% annually for sustainable packaging solutions. Companies are actively seeking materials that not only meet performance standards but also contribute to reducing carbon footprints. Consequently, the Polyethylene Furanoate Film Market is poised to benefit from this trend, as manufacturers innovate to meet the rising demand for eco-friendly products.

Technological Advancements

Technological advancements play a crucial role in shaping the Polyethylene Furanoate Film Market. Innovations in production processes and material formulations are enhancing the performance characteristics of polyethylene furanoate films. For instance, improvements in barrier properties and mechanical strength are making these films more competitive with conventional plastics. Market data suggests that the introduction of advanced manufacturing techniques could reduce production costs by up to 20%, thereby increasing accessibility for various applications. As technology continues to evolve, the Polyethylene Furanoate Film Market is likely to witness a surge in adoption across sectors such as food packaging, textiles, and electronics, where high-performance materials are essential.

Collaboration Across Industries

Collaboration across industries is becoming a vital driver for the Polyethylene Furanoate Film Market. Partnerships between material producers, packaging companies, and end-users are fostering innovation and accelerating the development of new applications for polyethylene furanoate films. Such collaborations can lead to the sharing of resources and expertise, ultimately enhancing product performance and market reach. For instance, joint ventures between technology firms and packaging manufacturers are exploring novel uses for these films in sectors like food and beverage, where sustainability is increasingly prioritized. This collaborative approach not only strengthens the Polyethylene Furanoate Film Market but also facilitates the introduction of cutting-edge solutions that meet diverse consumer needs.

Consumer Demand for Eco-Friendly Products

The rising consumer demand for eco-friendly products is a driving force in the Polyethylene Furanoate Film Market. As awareness of environmental issues grows, consumers are increasingly seeking products that minimize ecological impact. This trend is particularly evident in the packaging sector, where brands are responding by incorporating sustainable materials into their offerings. Market Research Future indicates that approximately 70% of consumers are willing to pay a premium for products made from renewable resources. This shift in consumer behavior is prompting manufacturers to invest in polyethylene furanoate films, which not only meet performance requirements but also resonate with environmentally conscious consumers, thereby expanding the market.