Rising Demand for Flexible Packaging

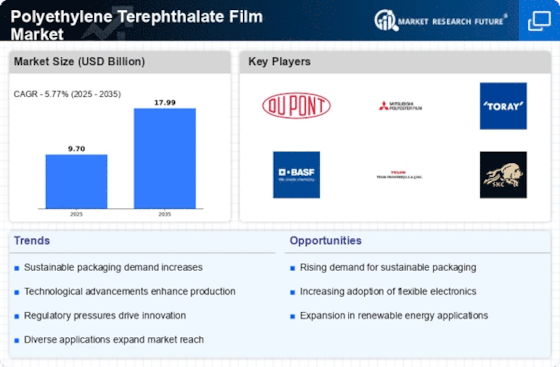

The Polyethylene Terephthalate Film Market is experiencing a notable surge in demand for flexible packaging solutions. This trend is largely driven by the increasing consumer preference for lightweight and convenient packaging options. Flexible packaging, which utilizes polyethylene terephthalate films, offers advantages such as reduced material usage and enhanced product shelf life. According to recent data, the flexible packaging segment is projected to grow at a compound annual growth rate of approximately 4.5% over the next five years. This growth is indicative of a broader shift towards sustainable packaging solutions, as manufacturers seek to minimize their environmental footprint while meeting consumer expectations. As a result, the Polyethylene Terephthalate Film Market is likely to benefit from this rising demand, positioning itself as a key player in the evolving packaging landscape.

Expanding Applications in the Food Industry

The Polyethylene Terephthalate Film Market is benefiting from the expanding applications of PET films in the food industry. With the growing emphasis on food safety and preservation, polyethylene terephthalate films are increasingly used for packaging perishable goods. Their excellent barrier properties help in extending the shelf life of food products, which is crucial in today's fast-paced consumer environment. Market analysis indicates that the food packaging segment is expected to grow by approximately 4% annually, driven by the rising demand for ready-to-eat meals and convenience foods. This trend underscores the importance of the Polyethylene Terephthalate Film Market in providing effective packaging solutions that meet the evolving needs of consumers and manufacturers alike.

Regulatory Support for Sustainable Materials

The Polyethylene Terephthalate Film Market is likely to benefit from increasing regulatory support for sustainable materials. Governments and regulatory bodies are implementing policies that encourage the use of recyclable and eco-friendly materials in packaging and other applications. This shift towards sustainability is prompting manufacturers to adopt polyethylene terephthalate films, which are known for their recyclability and lower environmental impact compared to traditional materials. Recent initiatives suggest that the market for sustainable packaging solutions could grow by 7% over the next few years. As regulations become more stringent, the Polyethylene Terephthalate Film Market is positioned to thrive, aligning with global sustainability goals and consumer preferences for environmentally responsible products.

Technological Innovations in Film Production

Technological advancements in the production of polyethylene terephthalate films are significantly influencing the Polyethylene Terephthalate Film Market. Innovations such as improved extrusion techniques and enhanced coating processes are enabling manufacturers to produce films with superior properties, including increased barrier performance and enhanced durability. These advancements not only improve the quality of the films but also reduce production costs, making them more competitive in various applications. Recent estimates suggest that the market for advanced film technologies could expand by 6% annually, reflecting the industry's commitment to innovation. As manufacturers adopt these technologies, the Polyethylene Terephthalate Film Market is poised for growth, driven by the demand for high-performance films across diverse sectors, including food packaging and electronics.

Growth in Electronics and Electrical Applications

The Polyethylene Terephthalate Film Market is witnessing substantial growth due to the increasing utilization of PET films in electronics and electrical applications. These films are favored for their excellent electrical insulation properties and thermal stability, making them ideal for use in capacitors, printed circuit boards, and other electronic components. The electronics sector is projected to expand at a rate of approximately 5% per year, which is likely to bolster the demand for polyethylene terephthalate films. As technology continues to advance, the need for reliable and efficient materials in electronic applications will further drive the Polyethylene Terephthalate Film Market, positioning it as a critical supplier to the burgeoning electronics market.