Pmoled Size

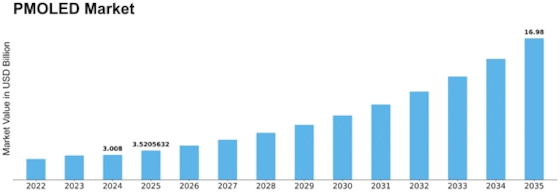

PMOLED Market Growth Projections and Opportunities

Numerous variables affect the PMOLED (Passive Matrix Organic Light Emitting Diode) industry, which together form its dynamics. The main driver of the market is the development of technology. PMOLED screens gain from advancements in flexibility, resolution, and efficiency as OLED technology develops further. These developments improve PMOLED panels' overall performance and increase their attractiveness for a range of uses, including consumer electronics, vehicle displays, and wearable technology.

The increasing need for small-sized and energy-efficient screens is another important driver. PMOLEDs are advantageous for devices where energy efficiency and space are critical because of their tiny form factors and low power consumption. The market's ability to adapt to consumer demand for smaller, lighter, and more power-efficient displays is shown by the growing use of PMOLEDs in smartphones, smartwatches, and fitness trackers.

Rising customer desire for bright, high-contrast screens also affects market dynamics. PMOLED technology is excellent at producing vibrant colors and deep blacks, which improves the visual experience. Manufacturers are forced to include PMOLEDs in order to match customers' expectations for display quality, which is fueling the development of the market.

Cost factors are a major factor in the PMOLED market's development. Even though OLED technology has generally traditionally been linked to increased production costs, this issue is being addressed by continuing research and development initiatives. The cost of producing PMOLED displays is anticipated to drop as production procedures become more simplified and effective, increasing their economic viability for a wider variety of applications.

The industry is also greatly affected by PMOLED displays' growing range of applications. PMOLEDs were first only used in tiny displays, but they are gradually making their way into bigger display applications like signs and dashboards for cars. This application variety broadens the market's appeal and lessens reliance on certain sectors, which supports the PMOLED market's overall development and stability.

The trajectory of the PMOLED market is also influenced by market trends and global economic considerations. PMOLED display price, distribution, and manufacturing may all be impacted by events like as trade policy changes, global supply chain interruptions, and economic downturns. The PMOLED market is also moving toward eco-friendly operations because to market trends including the growing emphasis on sustainability and environmental friendliness, which have an impact on material selection and production procedures.

The competitive environment in the display technology industry also has a big impact on the PMOLED market. To get a competitive advantage, producers compete fiercely, which fosters innovation and ongoing advancements in PMOLED technology. By encouraging the sharing of knowledge and resources, partnerships, collaborations, and strategic alliances among major companies further support the development of the PMOLED industry.

Leave a Comment