Expansion of Agricultural Land

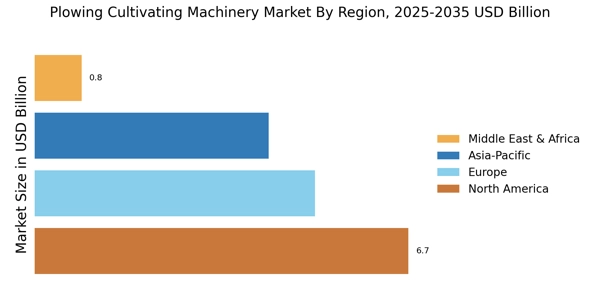

The expansion of agricultural land, particularly in developing regions, is a significant driver for the Plowing Cultivating Machinery Market. As more land is converted for agricultural use, there is an increasing need for efficient plowing and cultivating equipment to prepare these lands for farming. This trend is particularly evident in regions where agricultural practices are being modernized to improve productivity. The expansion of arable land is projected to contribute to a rise in the demand for agricultural machinery, with estimates indicating a potential increase in market size by over 8% in the coming years. Consequently, the Plowing Cultivating Machinery Market is poised for growth as farmers seek to equip newly cultivated lands with the necessary machinery.

Rising Demand for Food Production

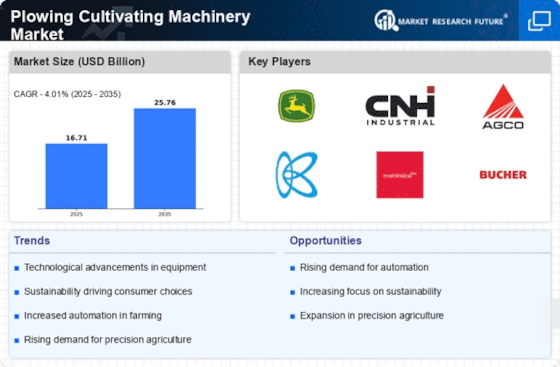

The increasing global population has led to a heightened demand for food production, which in turn drives the Plowing Cultivating Machinery Market. As agricultural practices evolve to meet this demand, farmers are increasingly investing in advanced plowing and cultivating machinery to enhance productivity. According to recent data, the agricultural machinery market is projected to grow at a compound annual growth rate of approximately 5.5% over the next few years. This growth is indicative of the necessity for efficient farming equipment that can support larger-scale operations and improve yield. Consequently, the Plowing Cultivating Machinery Market is likely to experience significant growth as farmers seek to optimize their operations and ensure food security.

Government Initiatives and Subsidies

Government initiatives aimed at modernizing agriculture play a crucial role in the Plowing Cultivating Machinery Market. Various countries have implemented subsidy programs to encourage farmers to adopt modern machinery, thereby enhancing productivity and sustainability. For instance, financial assistance for purchasing advanced plowing and cultivating equipment can significantly reduce the financial burden on farmers. This support not only promotes the use of efficient machinery but also aligns with broader agricultural policies focused on increasing food production and sustainability. As a result, the Plowing Cultivating Machinery Market is likely to benefit from these initiatives, fostering a more competitive and technologically advanced agricultural sector.

Technological Innovations in Machinery

Technological innovations are transforming the Plowing Cultivating Machinery Market, with advancements in precision agriculture and smart farming techniques. The integration of GPS technology, IoT devices, and automation in plowing and cultivating machinery enhances operational efficiency and reduces labor costs. For example, machinery equipped with precision guidance systems can optimize field operations, leading to better resource management and increased crop yields. The market for precision agriculture is expected to grow significantly, with estimates suggesting a potential increase of over 12% annually. This trend indicates that the Plowing Cultivating Machinery Market is evolving rapidly, driven by the need for more efficient and technologically advanced farming solutions.

Growing Awareness of Sustainable Practices

The growing awareness of sustainable agricultural practices is influencing the Plowing Cultivating Machinery Market. Farmers are increasingly recognizing the importance of environmentally friendly practices, which has led to a demand for machinery that minimizes soil disturbance and promotes soil health. Equipment designed for conservation tillage, for instance, is gaining traction as it helps reduce erosion and improve water retention. This shift towards sustainability is not only beneficial for the environment but also aligns with consumer preferences for sustainably produced food. As a result, the Plowing Cultivating Machinery Market is likely to see a rise in demand for machinery that supports sustainable farming practices.