Growing Focus on Crop Resilience

The increasing emphasis on developing resilient crops is a critical driver for the Plant Genotyping Equipment Market. With climate change posing significant challenges to agriculture, there is a pressing need for crops that can adapt to varying environmental conditions. Genotyping technologies play a vital role in identifying genetic traits associated with resilience, enabling breeders to select and develop robust plant varieties. The market is witnessing a shift towards research that prioritizes stress tolerance, disease resistance, and yield stability. Analysts predict that the demand for genotyping equipment will rise as more research institutions and agricultural companies focus on these objectives. This trend not only enhances food security but also positions the Plant Genotyping Equipment Market as a key player in addressing global agricultural challenges.

Government Initiatives and Funding

Government initiatives and funding programs aimed at enhancing agricultural productivity are significantly influencing the Plant Genotyping Equipment Market. Various governments are investing in research and development to promote sustainable agricultural practices and food security. These initiatives often include grants and subsidies for the adoption of advanced technologies, including plant genotyping equipment. For instance, funding for agricultural research has seen an uptick, with billions allocated to projects that focus on genetic research and crop improvement. This financial support not only encourages innovation but also stimulates market growth by making advanced genotyping technologies more accessible to researchers and farmers alike. As a result, the Plant Genotyping Equipment Market is poised for expansion, driven by these supportive governmental policies.

Integration of Genomics in Agriculture

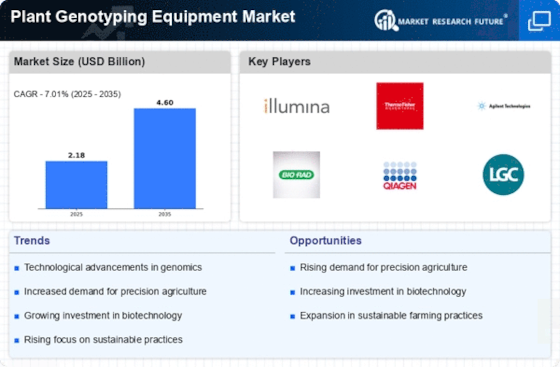

The integration of genomics into agricultural practices is a pivotal driver for the Plant Genotyping Equipment Market. As farmers and researchers increasingly recognize the value of genetic information in crop improvement, the demand for advanced genotyping tools is expected to rise. This integration facilitates the development of genetically modified organisms (GMOs) and improved crop varieties that can withstand environmental stresses. The market is witnessing a shift towards precision agriculture, where genomic data plays a crucial role in decision-making processes. Reports indicate that the genomics market in agriculture could reach several billion dollars by the end of the decade, underscoring the importance of plant genotyping equipment in this transformative phase. Thus, the Plant Genotyping Equipment Market is likely to benefit from this trend as more stakeholders adopt genomic technologies.

Rising Demand for High-Throughput Genotyping

The Plant Genotyping Equipment Market is experiencing a notable increase in demand for high-throughput genotyping technologies. This surge is primarily driven by the need for rapid and efficient genetic analysis in plant breeding programs. As agricultural practices evolve, breeders require tools that can process large volumes of samples quickly. The market for high-throughput genotyping is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. This trend indicates a shift towards more automated and efficient genotyping solutions, which are essential for enhancing crop yields and developing resilient plant varieties. Consequently, manufacturers are focusing on innovating their product lines to meet this growing demand, thereby propelling the Plant Genotyping Equipment Market forward.

Advancements in Bioinformatics and Data Analysis

Advancements in bioinformatics and data analysis are transforming the Plant Genotyping Equipment Market. As the volume of genetic data generated by genotyping technologies increases, the need for sophisticated data analysis tools becomes paramount. Bioinformatics solutions enable researchers to interpret complex genetic information, facilitating more informed decision-making in plant breeding. The market is seeing a growing integration of bioinformatics platforms with genotyping equipment, enhancing the overall efficiency of genetic research. This synergy is expected to drive market growth, as stakeholders seek comprehensive solutions that combine genotyping with advanced data analytics. Furthermore, the increasing availability of cloud-based bioinformatics tools is likely to democratize access to these technologies, further propelling the Plant Genotyping Equipment Market into a new era of innovation.