Growing Applications in Agriculture

The SNP Genotyping and Analysis Market is witnessing an expansion in its applications within the agricultural sector. As the global population continues to rise, there is an increasing need for sustainable agricultural practices and enhanced crop yields. SNP genotyping provides valuable insights into plant genetics, enabling the identification of traits associated with disease resistance, drought tolerance, and yield improvement. This information is crucial for developing genetically modified organisms (GMOs) and marker-assisted selection techniques. Recent market analyses suggest that the agricultural biotechnology sector, which heavily relies on SNP analysis, is poised for significant growth, potentially exceeding a market value of several billion dollars in the near future. This trend underscores the importance of SNP genotyping in addressing food security challenges and optimizing agricultural productivity.

Regulatory Support for Genetic Testing

The SNP Genotyping and Analysis Market is positively impacted by increasing regulatory support for genetic testing. Governments and regulatory bodies are recognizing the value of genetic information in improving healthcare outcomes and are implementing frameworks to facilitate the use of SNP genotyping in clinical settings. This support includes guidelines for the ethical use of genetic data and the establishment of standards for testing procedures. As a result, healthcare providers are more inclined to adopt SNP genotyping technologies, knowing that they are operating within a supportive regulatory environment. Market data suggests that the regulatory landscape is evolving to accommodate advancements in genetic testing, which is likely to enhance the credibility and acceptance of SNP analysis in both clinical and research applications. This trend is expected to contribute to the overall growth of the SNP Genotyping and Analysis Market.

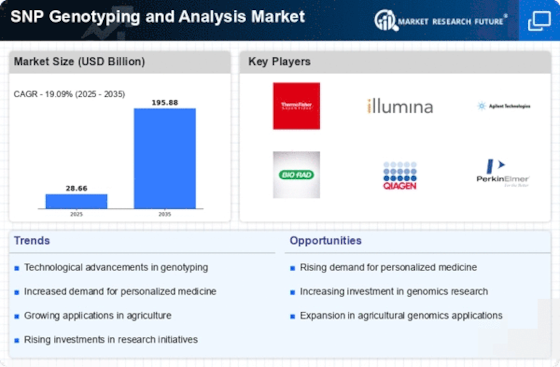

Rising Demand for Personalized Medicine

The SNP Genotyping and Analysis Market is significantly influenced by the increasing demand for personalized medicine. As healthcare shifts towards more individualized treatment approaches, the need for precise genetic information becomes paramount. SNP genotyping plays a crucial role in identifying genetic variations that can affect drug response and disease susceptibility. This trend is reflected in the growing number of clinical trials and studies focusing on pharmacogenomics, which utilize SNP analysis to tailor therapies to individual patients. Market data indicates that the personalized medicine sector is expected to reach a valuation of several billion dollars by the end of the decade, further driving the adoption of SNP genotyping technologies. Consequently, this rising demand is likely to propel the SNP Genotyping and Analysis Market forward, fostering innovation and investment in genetic research.

Increased Investment in Genomic Research

The SNP Genotyping and Analysis Market is benefiting from increased investment in genomic research across various sectors. Governments and private organizations are recognizing the importance of genomics in advancing healthcare, agriculture, and environmental sustainability. Funding initiatives aimed at supporting genomic research projects are on the rise, leading to enhanced capabilities in SNP genotyping technologies. This influx of capital is likely to accelerate the development of innovative tools and methodologies, thereby expanding the market's potential. Furthermore, collaborations between academic institutions and industry players are becoming more common, fostering a synergistic environment for research and development. As a result, the SNP Genotyping and Analysis Market is expected to thrive, with projections indicating a robust growth trajectory in the coming years.

Technological Advancements in SNP Genotyping

The SNP Genotyping and Analysis Market is experiencing a transformative phase due to rapid technological advancements. Innovations such as next-generation sequencing (NGS) and high-throughput genotyping platforms are enhancing the accuracy and efficiency of SNP analysis. These technologies enable researchers to process vast amounts of genetic data, thereby facilitating large-scale studies. The integration of bioinformatics tools further streamlines data interpretation, making it more accessible for researchers and clinicians alike. As a result, the market is projected to witness substantial growth, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. This technological evolution not only improves research outcomes but also expands the potential applications of SNP genotyping in various fields, including medicine and agriculture.

.png)