Health and Wellness Trends

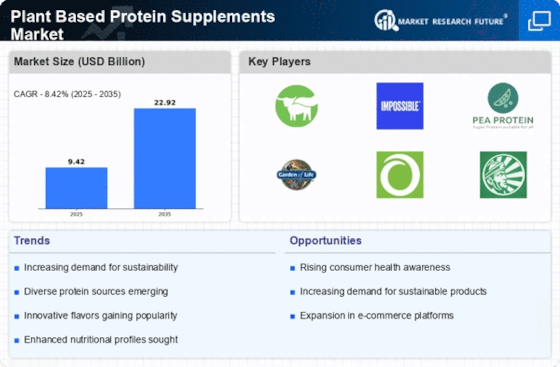

The ongoing emphasis on health and wellness is a critical driver for the Plant Based Protein Supplements Market. Consumers are increasingly seeking products that contribute to their overall well-being, leading to a heightened interest in nutritional supplements. Data suggests that the plant-based protein segment is projected to grow at a compound annual growth rate of around 8% over the next five years. This trend is fueled by a growing awareness of the health benefits associated with plant-based proteins, such as lower cholesterol levels and improved digestion. As consumers become more educated about nutrition, they are more likely to choose plant-based options over traditional protein sources. This shift not only reflects changing dietary habits but also indicates a broader movement towards sustainable and health-conscious living, further propelling the Plant Based Protein Supplements Market.

Rising Veganism and Vegetarianism

The increasing prevalence of veganism and vegetarianism is a notable driver in the Plant Based Protein Supplements Market. As more individuals adopt plant-based diets for ethical, environmental, or health reasons, the demand for plant-based protein supplements has surged. Reports indicate that the number of vegans has increased significantly, with estimates suggesting a growth rate of approximately 20% annually. This shift in dietary preferences has led to a corresponding rise in the availability and variety of plant-based protein products, catering to diverse consumer needs. Consequently, brands are innovating to create appealing flavors and formulations, thereby enhancing market penetration. The Plant Based Protein Supplements Market is thus experiencing a transformation, as it aligns with the values and preferences of a growing segment of the population.

Increased Availability of Products

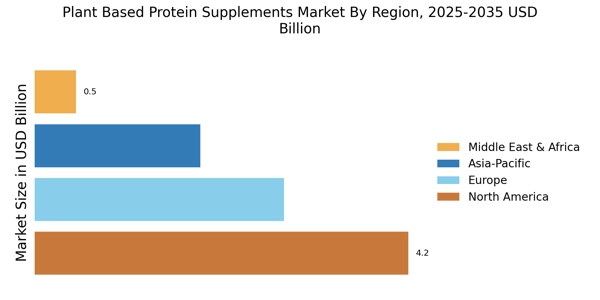

The increased availability of plant-based protein products is a significant driver for the Plant Based Protein Supplements Market. Retailers are expanding their offerings to include a wider range of plant-based protein supplements, from powders to ready-to-drink beverages. This expansion is facilitated by the growing consumer demand for convenient and accessible health products. Data indicates that the number of retail outlets carrying plant-based protein supplements has increased by over 30% in recent years. Additionally, the rise of e-commerce platforms has made it easier for consumers to access a variety of products from the comfort of their homes. This enhanced availability not only meets consumer demand but also encourages trial and adoption, further propelling the growth of the Plant Based Protein Supplements Market.

Sustainability and Environmental Concerns

Sustainability and environmental concerns are increasingly influencing consumer choices, thereby driving the Plant Based Protein Supplements Market. As awareness of climate change and environmental degradation grows, many consumers are opting for plant-based proteins as a more sustainable alternative to animal-based products. Research indicates that plant-based protein production typically requires fewer resources and results in lower greenhouse gas emissions compared to traditional livestock farming. This shift towards sustainability is not merely a trend but appears to be a fundamental change in consumer behavior. Brands that emphasize their commitment to sustainable practices are likely to resonate with environmentally conscious consumers, thereby enhancing their market position. The Plant Based Protein Supplements Market is thus positioned to benefit from this growing demand for eco-friendly products.

Technological Advancements in Food Production

Technological advancements in food production are playing a pivotal role in shaping the Plant Based Protein Supplements Market. Innovations in food technology, such as improved extraction methods and enhanced flavoring techniques, are enabling manufacturers to create high-quality plant-based protein supplements that appeal to a broader audience. These advancements not only improve the taste and texture of plant-based proteins but also enhance their nutritional profiles. Furthermore, the rise of alternative protein sources, such as lab-grown proteins and insect-based supplements, is diversifying the market landscape. As these technologies continue to evolve, they are likely to attract more consumers to the Plant Based Protein Supplements Market, thereby expanding its reach and potential.