Innovation in Product Development

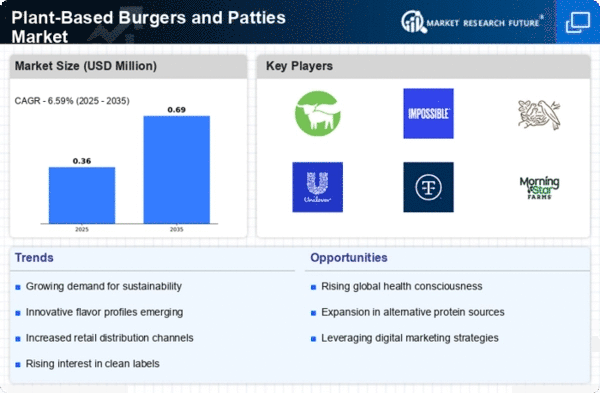

Innovation in product development is a crucial driver for the Plant-Based Burgers and Patties Market. As competition intensifies, companies are investing in research and development to create new and improved plant-based products that closely mimic the taste and texture of meat. This innovation is not limited to flavor; it also encompasses nutritional enhancements, such as fortifying products with vitamins and minerals. The introduction of novel ingredients, such as pea protein and mycelium, has expanded the possibilities for plant-based offerings. In 2025, the market saw a surge in new product launches, indicating a robust pipeline of innovative solutions. This continuous evolution in product development is likely to attract a broader consumer base, including those who may have previously been hesitant to try plant-based alternatives. As a result, the Plant-Based Burgers and Patties Market is poised for significant growth.

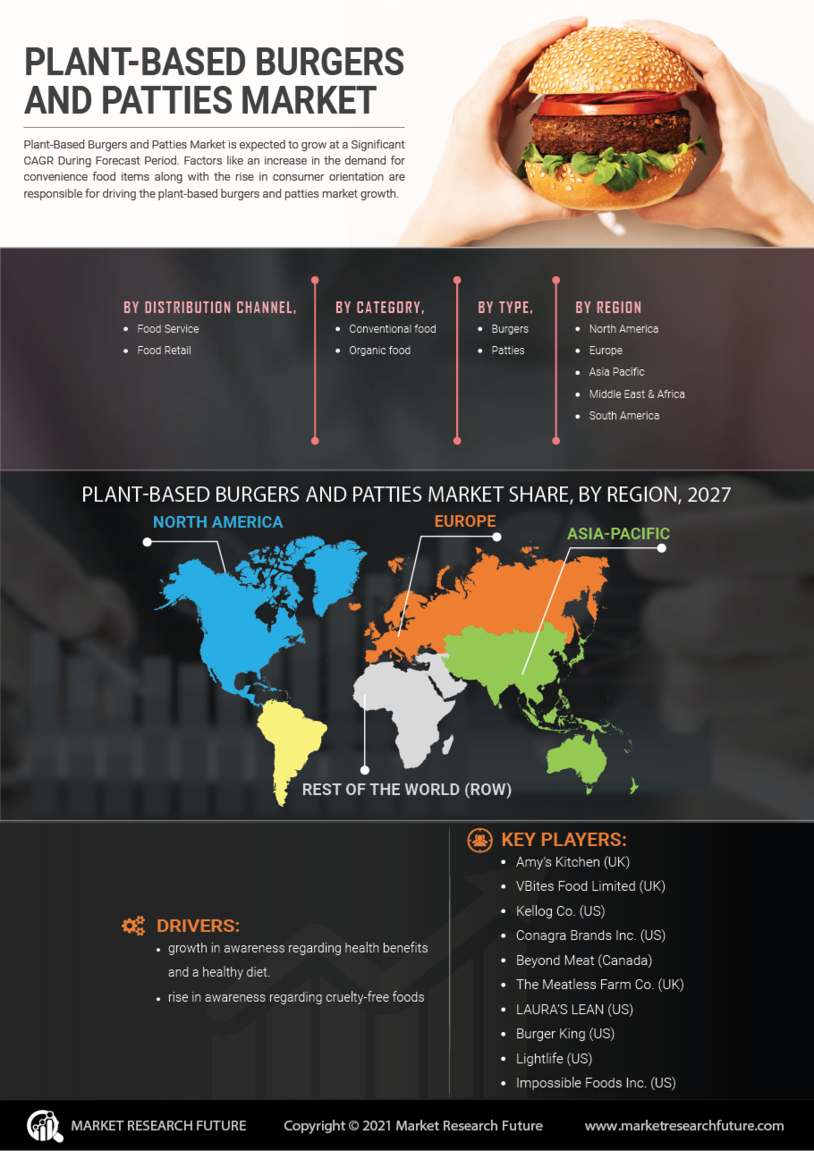

Health Consciousness Drives Demand

The increasing awareness of health and wellness among consumers appears to be a primary driver for the Plant-Based Burgers and Patties Market. As individuals become more conscious of their dietary choices, the demand for healthier alternatives to traditional meat products rises. Research indicates that plant-based diets can reduce the risk of chronic diseases, which further propels consumers towards plant-based options. In 2025, the market for plant-based foods reached a valuation of approximately 29 billion, reflecting a growing trend towards healthier eating habits. This shift is not merely a fad; it suggests a long-term change in consumer preferences, as more people seek to incorporate plant-based proteins into their diets. Consequently, the Plant-Based Burgers and Patties Market is likely to experience sustained growth as health-conscious consumers continue to prioritize nutritious food options.

Rising Vegan and Vegetarian Population

The rising population of vegans and vegetarians is a notable driver for the Plant-Based Burgers and Patties Market. As more individuals adopt plant-based diets for health, ethical, or environmental reasons, the demand for plant-based alternatives continues to grow. Recent surveys indicate that the number of people identifying as vegan has increased by over 300 percent in the last decade. This demographic shift is not only changing dietary habits but also influencing mainstream food offerings. Retailers and restaurants are increasingly expanding their plant-based menus to cater to this growing consumer base. The Plant-Based Burgers and Patties Market is likely to benefit from this trend, as more options become available to meet the needs of a diverse range of consumers seeking plant-based solutions.

Increased Availability and Accessibility

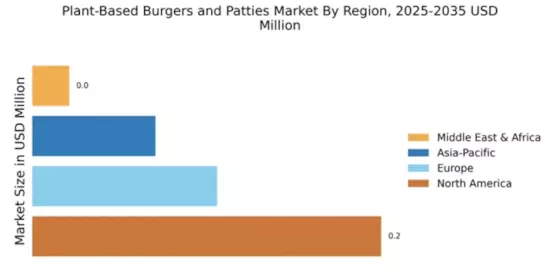

Increased availability and accessibility of plant-based products is a significant driver for the Plant-Based Burgers and Patties Market. As retailers and food service providers recognize the growing demand for plant-based options, they are expanding their offerings to include a wider variety of products. Major grocery chains are now dedicating entire sections to plant-based foods, making it easier for consumers to find and purchase these items. Additionally, the rise of online grocery shopping has further enhanced accessibility, allowing consumers to order plant-based products from the comfort of their homes. This trend is likely to continue, as more consumers seek convenient and accessible options. The Plant-Based Burgers and Patties Market stands to gain from this increased distribution, as it becomes more integrated into everyday shopping experiences.

Sustainability and Ethical Considerations

Sustainability concerns and ethical considerations regarding animal welfare are increasingly influencing consumer choices in the Plant-Based Burgers and Patties Market. As environmental issues gain prominence, many consumers are seeking alternatives that have a lower ecological footprint. The production of plant-based burgers and patties typically requires fewer resources and generates less greenhouse gas emissions compared to traditional meat production. Reports suggest that plant-based diets could reduce food-related emissions by up to 70 percent. This growing awareness of the environmental impact of food choices is likely to drive demand for plant-based products, as consumers align their purchasing decisions with their values. The Plant-Based Burgers and Patties Market stands to benefit from this trend, as more individuals opt for sustainable food options that contribute to a healthier planet.