Focus on Energy Efficiency

The Planar Lightwave Circuit Splitter Market is increasingly driven by a focus on energy efficiency within telecommunications. As energy costs rise and environmental concerns grow, companies are seeking solutions that minimize energy consumption while maximizing performance. Planar lightwave circuit splitters are known for their low power requirements and high efficiency, making them an attractive option for network operators aiming to reduce operational costs. The shift towards energy-efficient technologies is not only beneficial for the environment but also aligns with regulatory pressures to adopt greener practices. As a result, the market for these splitters is likely to expand as more operators prioritize energy-efficient solutions in their infrastructure investments. This trend reflects a broader movement within the telecommunications sector towards sustainability and responsible resource management.

Increasing Adoption of 5G Technology

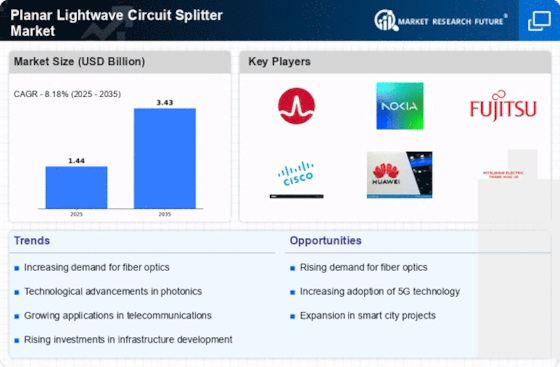

The Planar Lightwave Circuit Splitter Market is significantly impacted by the increasing adoption of 5G technology. As telecommunications companies roll out 5G networks, the demand for efficient optical components, including planar lightwave circuit splitters, is expected to rise. 5G technology requires a robust infrastructure capable of handling higher data rates and lower latency, which in turn necessitates advanced optical solutions. The integration of planar lightwave circuit splitters into 5G networks allows for effective signal distribution and management, thereby enhancing overall network performance. With projections indicating that 5G subscriptions could reach 1.5 billion by 2025, the market for planar lightwave circuit splitters is likely to experience substantial growth. This trend underscores the critical role that these devices play in supporting next-generation telecommunications.

Rising Demand for High-Speed Internet

The Planar Lightwave Circuit Splitter Market is significantly influenced by the rising demand for high-speed internet services. As consumers and businesses alike seek faster and more reliable internet connections, the need for robust fiber optic networks becomes paramount. This demand is particularly evident in urban areas where population density drives the necessity for enhanced connectivity solutions. According to recent estimates, the number of fiber optic subscribers is expected to reach over 200 million by 2026, creating a substantial market for planar lightwave circuit splitters. These devices play a crucial role in distributing optical signals efficiently, thereby supporting the infrastructure required for high-speed internet. Consequently, the growth in internet usage and the proliferation of smart devices are likely to further stimulate the demand for these splitters in the telecommunications sector.

Expansion of Telecommunications Infrastructure

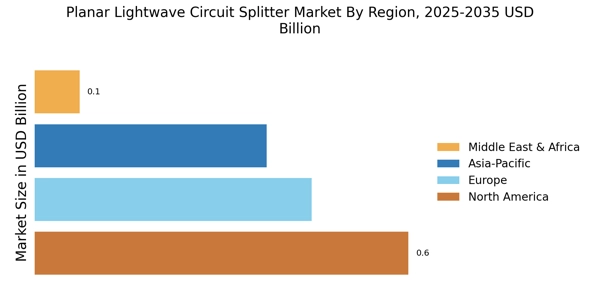

The Planar Lightwave Circuit Splitter Market is poised for growth due to the ongoing expansion of telecommunications infrastructure. Governments and private entities are investing heavily in upgrading and expanding their networks to accommodate the increasing data traffic. This expansion is particularly evident in developing regions, where the rollout of fiber optic networks is seen as a priority to bridge the digital divide. The market for planar lightwave circuit splitters is expected to benefit from these investments, as they are essential components in the deployment of fiber optic systems. With an estimated increase in global telecommunications spending projected to exceed 2 trillion dollars by 2025, the demand for efficient and reliable optical components, including splitters, is likely to rise correspondingly. This trend indicates a robust future for the planar lightwave circuit splitter market.

Technological Advancements in Optical Networks

The Planar Lightwave Circuit Splitter Market is experiencing a surge in technological advancements that enhance the performance and efficiency of optical networks. Innovations in manufacturing processes and materials have led to the development of more compact and reliable splitters. These advancements allow for better signal integrity and reduced insertion loss, which are critical for high-speed data transmission. As a result, the market is projected to grow at a compound annual growth rate of approximately 10% over the next five years. This growth is driven by the increasing need for bandwidth and the expansion of data centers, which rely heavily on efficient optical networking solutions. The integration of advanced technologies such as photonic integrated circuits further propels the capabilities of planar lightwave circuit splitters, making them indispensable in modern telecommunications.