Rising Demand in Energy Sector

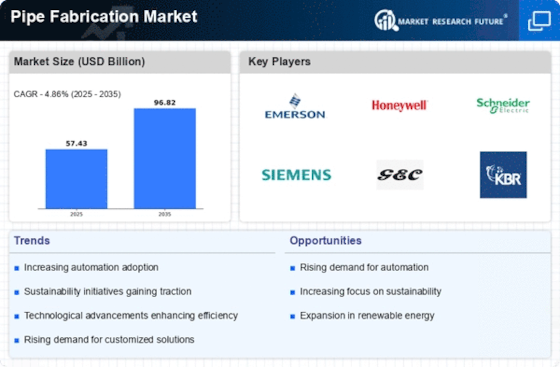

The energy sector is experiencing a notable surge in demand for pipe fabrication services, primarily driven by the expansion of oil and gas exploration activities. As countries seek to enhance their energy independence, investments in pipeline infrastructure are increasing. The Pipe Fabrication Market is poised to benefit from this trend, as the need for efficient and reliable transportation of hydrocarbons becomes paramount. According to recent estimates, the energy sector accounts for a substantial portion of the overall demand for fabricated pipes, with projections indicating a growth rate of approximately 5% annually. This growth is likely to stimulate innovations in fabrication techniques, thereby enhancing the overall efficiency and reliability of pipeline systems.

Growing Construction Activities

The construction industry is witnessing a robust growth trajectory, which is directly impacting the Pipe Fabrication Market. With urbanization and infrastructure development on the rise, the demand for fabricated pipes in construction projects is escalating. Recent data indicates that the construction sector is projected to grow at a rate of 6% annually, leading to increased requirements for piping systems in residential, commercial, and industrial buildings. This trend is likely to drive innovations in pipe fabrication techniques, as companies strive to meet the evolving needs of the construction market while ensuring compliance with stringent regulations.

Technological Innovations in Materials

Advancements in material science are playing a crucial role in shaping the Pipe Fabrication Market. The introduction of high-performance materials, such as composite and corrosion-resistant alloys, is enhancing the durability and efficiency of fabricated pipes. These innovations are particularly relevant in sectors like oil and gas, where the integrity of piping systems is critical. The market is witnessing a trend towards the adoption of these advanced materials, which are expected to drive growth in the fabrication sector. Analysts predict that the use of innovative materials could lead to a market expansion of approximately 4% annually, as industries seek to improve the longevity and performance of their piping systems.

Environmental Regulations and Compliance

The Pipe Fabrication Market is increasingly influenced by stringent environmental regulations aimed at reducing carbon emissions and promoting sustainability. Governments are implementing policies that require industries to adopt eco-friendly practices, including the use of sustainable materials in pipe fabrication. This regulatory landscape is pushing companies to innovate and develop greener fabrication processes. As a result, the market is likely to see a shift towards the use of recyclable materials and energy-efficient manufacturing techniques. The potential for growth in this area is substantial, as industries seek to align with environmental standards while maintaining operational efficiency.

Increased Focus on Industrial Automation

The ongoing trend towards industrial automation is significantly influencing the Pipe Fabrication Market. Automation technologies are being integrated into fabrication processes to enhance precision, reduce labor costs, and improve overall productivity. As industries adopt advanced manufacturing techniques, the demand for automated pipe fabrication solutions is expected to rise. Reports suggest that the automation market within the fabrication sector could grow at a compound annual growth rate of around 7% over the next few years. This shift not only streamlines operations but also ensures higher quality standards, which are critical in sectors such as construction and manufacturing.